Table of Contents >> Show >> Hide

- What You Actually Own When You Buy U.S. Stocks

- The Two Engines of Equity “Miracles”: Growth and Shareholder Return

- Why U.S. Equities Became a Global Heavyweight

- The Market Has Survived Everything… So Far

- Valuations MatterJust Not on Your Preferred Timeline

- The “Stay Invested” Advantage: Boring Wins Again

- So… Is the U.S. Equity Miracle Guaranteed?

- A Wealth of Common Sense Playbook for Real People

- Conclusion: The Miracle Is Mostly Mathand Mostly You

- Experiences: 3 Realistic (Composite) Investor Stories About the U.S. Equity “Miracle”

U.S. stocks have a superpower: they keep finding a way to go up over long stretches of timethrough wars, recessions, inflation spikes, political drama, tech bubbles, housing busts, pandemics, and whatever fresh plot twist the world writers’ room produces next.

Is it magic? Not really. It’s more like a boring, beautiful machine: millions of people building companies, companies earning profits, profits compounding, dividends getting reinvested, productivity rising, and investors (eventually) remembering that ownership in productive businesses tends to beat hiding money under the mattress.

This is “the miracle” of U.S. equitiespowered by common sense: own a slice of a system designed to innovate, compete, and pay shareholders over time. The trick isn’t discovering a secret stock handshake. The trick is staying invested long enough for the machine to do what it’s been doing for generations.

What You Actually Own When You Buy U.S. Stocks

Buying a stock isn’t buying a lottery ticket. You’re buying a claim on future cash flowsearnings, dividends, buybacks, and reinvestment that (hopefully) turns into more earnings later. The U.S. public market is essentially a giant mall of businesses: cloud computing next to toothpaste, semiconductors next to soda, insurance next to streaming subscriptions.

That diversity matters because “the market” isn’t one story. It’s thousands of stories. Some flame out spectacularly. Others quietly compound like a slow cooker. Over time, the winners tend to carry the indexone reason broad U.S. equity indexes have historically recovered from major drawdowns and marched to new highs again and again.

The Index Is a Self-Updating Organism

One underappreciated feature of broad U.S. indexes: they evolve. Yesterday’s market leaders aren’t guaranteed a permanent throne. New industries emerge, old ones shrink, and indexes naturally reweight toward what’s growing. You don’t have to predict the next big thing perfectly to benefit from long-term economic progress. You just have to keep owning a broad slice of it.

The Two Engines of Equity “Miracles”: Growth and Shareholder Return

Long-run stock returns aren’t one mysterious number that drops from the sky. They’re driven by a few understandable components: inflation, real growth in earnings, dividends, and changes in valuation (how much investors are willing to pay for each dollar of earnings). Over long periods, the “story” is surprisingly grounded in business fundamentals.

Engine #1: Business Growth (Earnings and Productivity)

Companies don’t grow in a vacuum. They grow when workers produce more per hour, when technology improves processes, when capital gets invested, and when entrepreneurs build products people actually want. In plain English: productivity is the quiet hero. If productivity rises, profits have room to rise, and equity values can rise with them.

That’s why productivity data and corporate profit trends mattereven if they aren’t as exciting as a meme-stock chart. Over time, U.S. markets have benefited from deep capital markets, strong corporate formation, and a culture (for better or worse) obsessed with building and scaling businesses.

Engine #2: Shareholder Return (Dividends, Buybacks, and Reinvestment)

Price appreciation gets the headlines, but dividends have historically been a meaningful chunk of total return. If you’ve ever wondered why long-term charts look so “miraculous,” part of the answer is simply math: reinvesting cash payments and letting compounding do the heavy lifting.

Here’s the intuitive version: when dividends are reinvested, you don’t just earn returns on your original sharesyou earn returns on the shares you bought with dividends, and the shares you bought with those dividends, and so on. It’s like a snowball, except the snowball is made of quarterly cash distributions and mild investor patience.

Why U.S. Equities Became a Global Heavyweight

Like it or not, global investors treat the U.S. stock market as the center of gravity for public equities. U.S. companies dominate many high-profit, high-scale industries (software, cloud infrastructure, advanced chips, consumer platforms, biotech), and U.S. markets offer depth and liquidity that are hard to match.

Scale, Liquidity, and “Everyone Shows Up Here”

U.S. equities aren’t just bigthey’re conveniently big: easy to access, heavily researched, and widely held through mutual funds and ETFs. That global participation can create a reinforcing cycle: liquidity attracts investors, investors attract listings, listings attract more liquidity. It’s not a guarantee of future outperformance, but it helps explain why U.S. markets hold such a large share of global equity value.

There’s also a “network effect” element: major indexes, retirement systems, and investment products are built around U.S. benchmarks, and the world has a habit of benchmarking itself against the S&P 500 the way runners benchmark themselves against a marathon time. It’s not always fair. It’s just what people do.

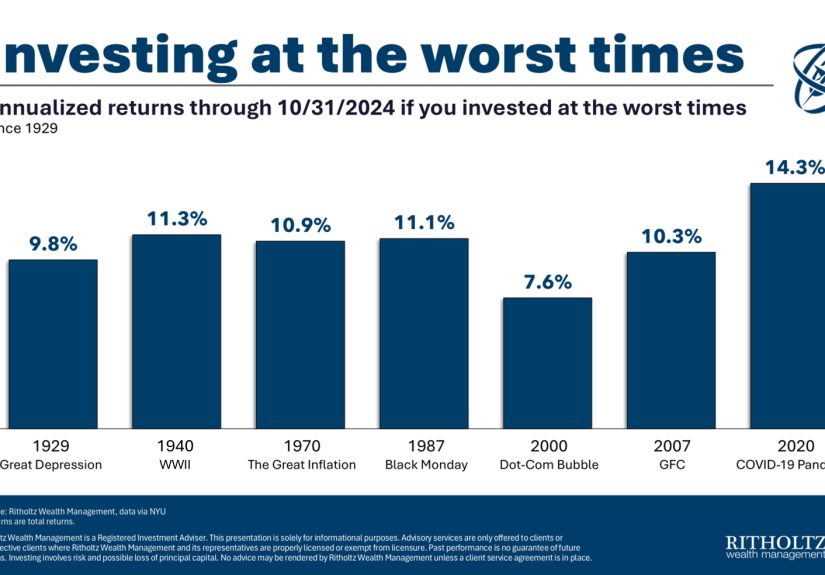

The Market Has Survived Everything… So Far

If you zoom out far enough, the chart of U.S. equities looks like a staircase with occasional trapdoors. Investors have endured:

- the Great Depression and multiple banking crises,

- World War II and geopolitical shocks,

- 1970s stagflation and brutal interest-rate cycles,

- the 1987 crash,

- the dot-com bubble and its hangover,

- the 2008 global financial crisis,

- the COVID crash and rapid rebound,

- and the constant background noise of “this time is different.”

And yet, diversified U.S. equities have historically recovered and compounded over multi-decade horizons. The miracle isn’t that downturns don’t happen. The miracle is that innovation and reinvestment tend to continue even when headlines scream like they’re auditioning for a disaster movie.

The “Bad News” Paradox

Markets are forward-looking. They tend to price in fear quickly and then recover before the mood improves. That’s why the scariest moments often overlap with the best long-term opportunitiesright when it feels least comfortable. If you’ve ever looked back and thought, “Wow, buying then would’ve been amazing,” congratulations: you have identified the emotional reason most people didn’t.

Valuations MatterJust Not on Your Preferred Timeline

Common sense also means admitting a hard truth: starting valuation affects long-run returns. Paying a very high price for earnings can lower expected future returns, especially over the next 5–10 years. But valuations are also famously unreliable as short-term timing tools. Expensive markets can stay expensive. Cheap markets can stay cheap. The market does not RSVP to your calendar.

A Practical View of the CAPE Ratio

Measures like the Shiller CAPE can be useful for setting expectations: they can hint when future returns might be lower than the historical average. The mistake is using valuation as a day-trading signal. Common sense investing uses valuation to avoid delusionnot to predict next Tuesday.

The “Stay Invested” Advantage: Boring Wins Again

There’s a reason so many reputable investment firms keep publishing versions of the same warning: trying to time the market is costly. The best days often cluster around the worst daysduring scary, volatile periods. Miss the rebound, and long-term results can change dramatically.

Why Missing a Few Good Days Hurts So Much

Market recoveries can be sudden. If you bail out after a drop and wait for “clarity,” you may end up buying back in after prices have already moved higher. That’s not a moral failure. It’s human nature. But it’s also why disciplined strategies (automatic investing, rebalancing, diversified indexing) exist: to protect you from your own very normal brain.

So… Is the U.S. Equity Miracle Guaranteed?

No. And pretending otherwise is not common senseit’s a sales pitch with better hair. U.S. equities carry real risks:

- Concentration risk (a handful of megacaps can dominate index performance),

- valuation risk (high prices can reduce future returns),

- inflation and rate risk (which can compress valuations),

- policy and geopolitical risk (markets hate uncertainty),

- behavioral risk (panic-selling at the worst time is undefeated).

The miracle is not that U.S. stocks always go up in a straight line. The miracle is that a diversified ownership claim on productive businesses has historically rewarded patience more often than it punished it.

A Wealth of Common Sense Playbook for Real People

If you want to participate in the long-run compounding machine without turning investing into a second full-time job, here’s a practical framework:

1) Own the Market (and Let It Evolve)

Broad, low-cost index exposure reduces single-company risk and automatically adapts to economic change. You get the winners without needing to guess them in advance.

2) Reinvest What You Can

Dividends and reinvestment help compounding. If you need income, that’s finejust be intentional. If you don’t, reinvesting is often the quiet multiplier in long-term results.

3) Use a Simple Risk System

Choose a stock/bond mix you can live with during ugly markets. If you can’t sleep at night, your allocation is too aggressive (or your caffeine intake is too ambitious).

4) Automate the Good Decisions

Regular contributions, disciplined rebalancing, and ignoring daily noise are not glamorous. They are also how many investors actually build wealth.

5) Expect Volatility as the “Admission Fee”

The market doesn’t hand out long-term returns for free. Volatility is the price you pay to earn a return above cash over long horizons. The fee feels outrageous in the momentthen looks reasonable in the rearview mirror.

Conclusion: The Miracle Is Mostly Mathand Mostly You

U.S. equities look miraculous because compounding is unintuitive, reinvestment is powerful, productivity tends to rise over time, and the market is designed to reflect the growth of corporate earnings and shareholder cash flows. But the real miracle ingredient is investor behavior: staying diversified, staying invested, and refusing to let fear drive every decision.

In other words: the “miracle” isn’t a secret. It’s common sensepracticed consistently.

Experiences: 3 Realistic (Composite) Investor Stories About the U.S. Equity “Miracle”

Note: The following are composite stories inspired by common investor experiences. They’re not advice and they’re not meant to pretend life is tidy. They’re meant to show what “A Wealth of Common Sense” looks like when the market stops being an abstract chart and starts being your actual emotions.

Story #1: The New Investor Who Accidentally Bought a Crisis

Jordan starts investing with perfect timingmeaning the worst timing. A first job, a 401(k) enrollment form, and a cheerful HR rep saying, “Just pick a target-date fund.” Two months later, the market drops hard. Jordan’s account balance looks like it tripped down a staircase.

The temptation is immediate: “I should stop contributions until things settle.” That feels sensible because humans are wired to avoid danger, and red numbers look like danger. But Jordan keeps the automatic contributions on. Not because of braverybecause Jordan is busy, slightly confused by the investment menu, and the contributions happen in the background.

Months later, markets recover. Years later, Jordan realizes those scary months bought shares at lower prices. The “miracle” wasn’t predicting the bottom. It was accidentally practicing discipline. The lesson Jordan carries forward is simple: automation protects you from your own instincts.

Story #2: The Mid-Career Investor Who Learned the Difference Between “News” and “Plan”

Casey has been investing for a decade. Then the world goes sideways. The headlines get louder, social media gets hotter, and every chart seems to come with an implied siren. Casey checks the portfolio too often, which is like stepping on a scale every five minutes and wondering why it’s not improving your health.

Casey considers “going to cash until it’s over.” But what is “over,” exactly? A week without scary news? A month? A year? Markets can rebound while the news still feels awful. And waiting for emotional comfort can become a habit that quietly erodes returns.

Instead, Casey makes one change that feels almost boring: rebalancing. When stocks fall, the portfolio becomes more conservative than intended. Rebalancing means trimming what held up better (often bonds or cash) and adding to what fell (stocks). It feels backward. It also turns volatility into a rule-based action rather than a panic response.

Casey’s takeaway: you don’t need a forecastyou need a process. The miracle is not avoiding downturns; it’s having a plan that survives them.

Story #3: The Near-Retiree Who Stopped Treating Stocks Like a Light Switch

Sam is five years from retirement and suddenly realizes that “stocks” aren’t a single risk bucket. Sam used to think in extremes: either 100% confident or 100% terrified. But retirement planning forces nuance. Sam learns to separate time horizons: money needed next year shouldn’t be invested like money needed 20 years from now.

So Sam builds “buckets” (or simply uses a balanced allocation): near-term spending in safer assets, longer-term funds still in diversified equities. This reduces the chance of selling stocks at the worst moment to fund living expenses. It doesn’t remove risk, but it reduces the most dangerous kind: being forced to sell after a big drop.

Over time, dividends and total returns help replenish the plan. Sam stops thinking of equities as a casino and starts thinking of them as ownership in an economy that keeps producing goods and services. The miracle becomes less mystical and more practical: structure turns anxiety into something manageable.

The shared thread: none of these investors “won” by predicting the future. They won by building habits that made it easier to stay invested, reinvest, and stick to a diversified plan. That’s the most realistic version of the U.S. equity miracleand the most repeatable one.