Table of Contents >> Show >> Hide

- What Is Customer Sentiment Analysis?

- Why Customer Sentiment Analysis Matters

- Common Types of Customer Sentiment Analysis

- Where to Collect Data for Customer Sentiment Analysis

- How to Collect Data for Customer Sentiment Analysis (Step-by-Step)

- Step 1: Define the business question (don’t boil the ocean)

- Step 2: Map touchpoints and inventory your feedback sources

- Step 3: Choose your collection methods (and match them to the moment)

- Step 4: Write questions that produce usable text (without annoying people)

- Step 5: Standardize how feedback gets captured and stored

- Step 6: Handle privacy, consent, and data hygiene like a professional (because you are one)

- Step 7: Collect continuously, not just when you’re panicking

- Step 8: Prepare the data for analysis (clean it like you mean it)

- Step 9: Analyze sentiment with the right approach for your maturity level

- Step 10: Validate results and measure model quality (yes, even if it “looks right”)

- Step 11: Turn sentiment into action (the only step the business actually cares about)

- What to Track: Practical Sentiment Metrics You Can Actually Use

- Common Pitfalls (and How to Avoid Them)

- Quick Examples: What Sentiment Analysis Can Reveal

- Conclusion

- Field Notes: 5 Real-World Experiences That Make Sentiment Analysis Click

- 1) The first dataset is always messier than you expect

- 2) Customers can love you and still be mad at you (simultaneously)

- 3) The best insights come from combining text with context

- 4) Your sentiment program works when teams can’t ignore it

- 5) Customers notice when you act on feedback (and they reward you)

Customers are already telling you how they feel. Sometimes they do it politely in a survey. Sometimes they do it in ALL CAPS

at 11:47 p.m. in a support chat. And sometimes they do it with a single emoji that somehow conveys: “I’m disappointed, but I’m

also trying to be a bigger person.”

Customer sentiment analysis turns those feelingsacross reviews, surveys, calls, tickets, social posts, and

moreinto usable insight. It’s not mind-reading. It’s pattern-finding. And when you collect the right data the right way,

it becomes one of the fastest routes to better customer experience (CX), smarter product decisions, and fewer “Why are we

losing customers?” meetings.

What Is Customer Sentiment Analysis?

Customer sentiment analysis is the process of collecting customer feedback and analyzing it to understand

how customers feel about your brand, product, service, or specific experiences. Most sentiment systems classify feedback as

positive, negative, or neutral, and more advanced setups can detect

mixed emotions, urgency, and even emotion categories (like frustration,

delight, confusion, or trust).

The “analysis” part typically uses a mix of techniques: manual tagging, rules/lexicons, machine learning models, and

increasingly, modern NLP systems that understand context (because “This is sick” can be praise, not a request for antibiotics).

Sentiment vs. Satisfaction Metrics (NPS, CSAT, CES)

Sentiment analysis is often paired with classic customer experience metrics:

- CSAT (Customer Satisfaction Score): “How satisfied were you with this interaction?” Great for moment-in-time touchpoints.

- NPS (Net Promoter Score): “How likely are you to recommend us?” A broad loyalty/relationship signal.

- CES (Customer Effort Score): “How easy was it to accomplish your goal?” A strong friction detector.

Those metrics give you a number. Sentiment analysis explains the whyespecially when you collect open-ended comments

(the gold) alongside the rating (the label).

Why Customer Sentiment Analysis Matters

If you’ve ever had a “But our dashboard looks fine” moment right before churn spikes, sentiment analysis is your reality check.

It helps you:

- Spot churn risk early by detecting rising frustration or repeated complaints.

- Find product and CX pain points by analyzing what people mention most (and how they feel about it).

- Prioritize fixes based on impact, frequency, and intensitynot whoever yells loudest in Slack.

- Measure change over time after launches, pricing updates, policy shifts, or support process changes.

- Improve team coaching using support and call sentiment trends (without turning it into a surveillance sitcom).

Common Types of Customer Sentiment Analysis

1) Polarity sentiment (the classic)

The simplest model: positive / negative / neutral. This is useful for high-level trending and dashboards, but it can miss

nuancelike “I love the product, but onboarding made me question my life choices.”

2) Aspect-based sentiment (the “what exactly is the problem?” version)

Aspect-based sentiment analysis separates topics (aspects) from emotion. Example:

“The camera is amazing, but the battery drains fast.”

- Camera: positive

- Battery: negative

This is the difference between “People are mad” and “People are mad about shipping delays in the Midwest after 6 p.m.”

3) Emotion detection (frustration, delight, anxiety, etc.)

Emotion labels can help support teams route urgent issues and help product teams distinguish “confused” from “angry,” which

require different fixes (and different apology fonts).

4) Intent + sentiment (what they feel and what they want)

Pair sentiment with intent like “cancel,” “refund,” “bug report,” “feature request,” “billing question,” or “how-to help.”

This improves triage and makes automation less… brave.

Where to Collect Data for Customer Sentiment Analysis

Sentiment analysis lives and dies by the data you feed it. The goal is to collect feedback across the customer journey,

not just at the “Please rate us!” moments.

Direct feedback (you asked for it)

- Surveys: NPS, CSAT, CES, post-purchase, post-support, onboarding, churn/exit surveys

- In-app micro-feedback: “Was this helpful?” prompts, feature polls, feedback widgets

- Customer interviews and usability tests

- Community forums and customer advisory boards

Operational feedback (they needed help)

- Support tickets (helpdesk systems, email support)

- Live chat transcripts and chatbot handoffs

- Call recordings and transcripts from contact centers

- Returns, complaints, and escalation logs

Public feedback (they told the internet)

- Review sites (industry-specific platforms, app stores, marketplaces)

- Social media mentions, comments, and DMs

- Reddit/communities and blog comments (where feelings are never understated)

- Competitor comparisons in public threads and reviews

Behavioral signals (they voted with their clicks)

Behavioral data isn’t “sentiment” by itself, but it’s a powerful companion dataset. Examples include:

rage clicks, repeated error screens, long time-to-complete, abandonment, churn events, refund requests, and feature drop-off.

When paired with qualitative feedback, these signals explain not only what customers did, but why.

How to Collect Data for Customer Sentiment Analysis (Step-by-Step)

Step 1: Define the business question (don’t boil the ocean)

Start with a clear question tied to a decision:

- “What are the top drivers of negative sentiment in onboarding?”

- “How did sentiment change after the pricing update?”

- “Which support topics correlate with churn within 30 days?”

Narrow scope by customer segment, product line, channel, region, or time window. You can always expand once the pipeline works.

Step 2: Map touchpoints and inventory your feedback sources

Make a quick list of where customer language already exists. Most organizations discover they’re sitting on a mountain of

“unstructured feedback” they’ve never analyzedlike support tags, chat logs, and email threads.

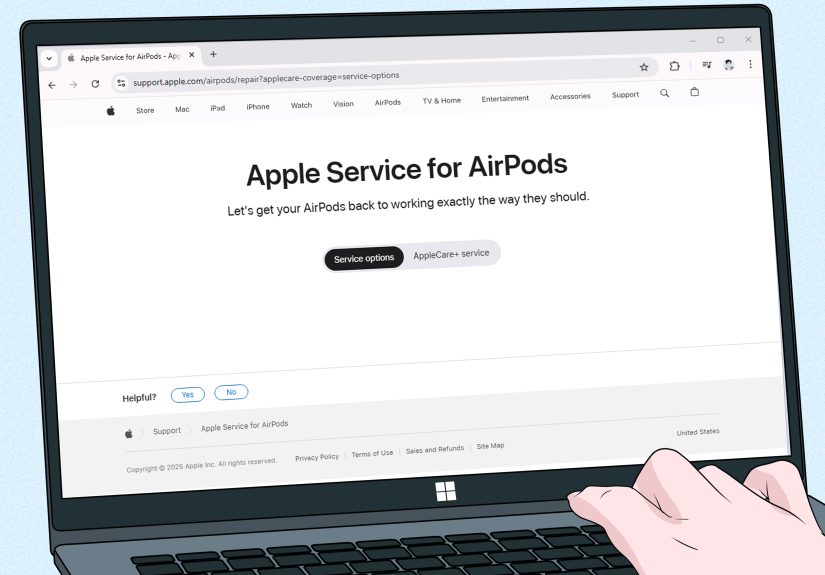

Step 3: Choose your collection methods (and match them to the moment)

The best time to collect feedback is when the customer can actually remember what happened.

- After a key interaction (support chat, delivery, onboarding milestone): use CSAT + one open-ended question.

- After a task is completed (account setup, return process): use CES + “What made it easy or difficult?”

- On a cadence (quarterly/biannual): use NPS + “What’s the main reason for your score?”

- At churn/return: use an exit survey + optional follow-up interview.

Step 4: Write questions that produce usable text (without annoying people)

Sentiment models love open-ended responses, but customers don’t love writing essays. Keep it light:

- Good: “What’s one thing we could do to improve your experience?”

- Good: “What almost stopped you from completing your purchase today?”

- Avoid: “Please describe your feelings about our omnichannel customer-centric synergy.”

Limit open-ended questions to one or two per survey when you want higher completion. Use branching logic if you need depth

(e.g., ask for details only when the score is low).

Step 5: Standardize how feedback gets captured and stored

If feedback lives in ten tools and three spreadsheets named “final_v7_REALfinal.xlsx,” analysis becomes a scavenger hunt.

Create a simple standard for every data record:

- Customer identifier (or anonymized ID)

- Channel (survey, review, ticket, call, social)

- Date/time

- Touchpoint (onboarding, billing, renewal, delivery)

- Text (the feedback itself)

- Optional context (plan tier, region, device, agent/team, product area)

Even basic normalization makes trend analysis dramatically easier.

Step 6: Handle privacy, consent, and data hygiene like a professional (because you are one)

Sentiment analysis often involves personal data, especially in calls, chats, and emails. Keep your collection practices

aligned with privacy expectations and applicable laws:

- Minimize data: collect what you need; avoid storing sensitive details you won’t analyze.

- Disclose recording: if you record calls, use clear notifications and follow consent requirements, especially across states.

- Respect consumer rights: if you collect data from customers in regulated jurisdictions (like California), support opt-out/rights requests as required.

- Remove or mask PII in datasets used for modeling and analytics whenever feasible.

Trust is part of the customer experience. If customers feel surveilled, sentiment will not improve. (It will, however, become very “honest.”)

Step 7: Collect continuously, not just when you’re panicking

A one-week feedback sprint is better than nothing, but sentiment analysis shines when it’s ongoing. Build lightweight routines:

- Weekly ingestion of new reviews and tickets

- Monthly sentiment trend review by product/CX teams

- Real-time alerts for spikes in negative sentiment for critical topics (billing, outages, safety)

Step 8: Prepare the data for analysis (clean it like you mean it)

Before you analyze, clean:

- De-duplicate near-identical submissions (especially in review campaigns)

- Detect language and route non-English content appropriately

- Strip signatures, boilerplate, and auto-replies from emails

- Normalize timestamps and metadata fields

- Mask personal information in free text where possible

This step is unglamorous. It’s also the step that separates “insight” from “confetti cannon of random quotes.”

Step 9: Analyze sentiment with the right approach for your maturity level

You don’t need a PhD or a GPU farm to start. Choose a method based on volume, complexity, and risk:

Option A: Manual tagging (best for small volumes or early pilots)

Tag a sample of feedback by sentiment and theme. This builds shared understanding, creates a starter taxonomy, and gives you

labeled data for future models.

Option B: Lexicon/rule-based sentiment (fast, transparent, but context-limited)

Lexicon methods use word lists and rules. They’re easy to implement and explain, but they struggle with sarcasm, domain language,

and context shifts (“This update is insane” might be praise).

Option C: Machine learning / modern NLP models (stronger context, needs evaluation)

ML and transformer-based approaches generally handle context better, but they require careful evaluation, ongoing monitoring,

and sometimes domain adaptation. A hybrid setuprules for obvious cases + ML for nuanceoften works well in business settings.

Step 10: Validate results and measure model quality (yes, even if it “looks right”)

Spot-check samples regularly. Track accuracy on a labeled set, and watch for drift when:

product naming changes, new features launch, policies shift, or meme language evolves (it will).

Step 11: Turn sentiment into action (the only step the business actually cares about)

Sentiment analysis is not a dashboard decoration. Make it operational:

- Route negative sentiment with “cancel” intent to retention workflows

- Prioritize recurring negative aspects for product fixes

- Coach teams based on conversation sentiment patterns, not one-off anecdotes

- Close the loop by responding to customers and tracking whether sentiment improves after changes

What to Track: Practical Sentiment Metrics You Can Actually Use

- Sentiment distribution: % positive / negative / neutral by channel and touchpoint

- Sentiment trend: week-over-week change (especially after releases or incidents)

- Aspect sentiment: top topics driving negative sentiment (e.g., “billing,” “shipping,” “login,” “support wait time”)

- Volume-weighted sentiment: prioritize issues that are both negative and frequent

- Time-to-resolution vs sentiment: see how resolution speed affects emotion

- Segment breakdown: sentiment by plan tier, region, device, or customer lifecycle stage

Common Pitfalls (and How to Avoid Them)

1) Sampling bias

The loudest customers are not always the most representative. Balance sources: surveys + support + reviews + behavioral signals.

2) “Star rating = sentiment” shortcuts

A 3-star review can be “love it, but shipping was late,” and a 5-star review can include a hidden warning. Always analyze text.

3) Ignoring fake or manipulated reviews

Public review ecosystems can be messy. Use fraud signals where possible, and treat suspicious bursts carefully.

If reviews are part of your dataset, your process should distinguish authentic feedback from noise.

4) Over-automation without human checks

Models can misread sarcasm, slang, and edge cases. Keep humans in the loop for taxonomy updates, spot checks, and critical decisions.

5) Collecting lots of data… and doing nothing with it

If customers take time to share feedback, reward that effort with visible improvements. Otherwise, future feedback will become

shorter, colder, and eventually nonexistent.

Quick Examples: What Sentiment Analysis Can Reveal

- E-commerce: Negative sentiment spikes around “delivery” and “packaging” after switching carriersproduct sentiment stays stable.

- SaaS: Onboarding sentiment is mixed: users love features but feel confused by setup. A guided checklist reduces negative “confusion” emotion tags.

- Subscription service: “Billing” is the top churn driver; sentiment turns negative right after renewal. A clearer renewal notice reduces complaints.

- Support: Customers with long first-response time show significantly more negative sentiment, even when issues are resolved.

Conclusion

Customer sentiment analysis is how you scale empathy without pretending your company is a telepathic dolphin.

It helps you understand how customers feel, what they’re reacting to, and where to focus improvements.

The winning formula is simple (and wonderfully unglamorous): collect feedback across channels, standardize it, protect customer privacy,

analyze it with methods that match your maturity, validate results, andmost importantlyuse the insight to make changes customers can feel.

Field Notes: 5 Real-World Experiences That Make Sentiment Analysis Click

This section is the “what it looks like in the wild” versionbecause sentiment analysis isn’t just a model; it’s a habit.

Here are experiences that teams repeatedly run into (and learn from) when they put customer sentiment analytics into practice.

1) The first dataset is always messier than you expect

Teams often start with support tickets because they’re plentiful and already in one system. Then reality arrives: half the “text”

is agent macros, automated greetings, forwarded email chains, or customers pasting order numbers like they’re playing bingo.

The fix isn’t fancystrip boilerplate, remove signatures, and store the “customer message” separately from internal notes.

Once you do, sentiment accuracy jumps, and suddenly your top negative drivers aren’t “Hello,” “Thanks,” and “Kind regards.”

2) Customers can love you and still be mad at you (simultaneously)

One common surprise is how often feedback is mixed: “Your product is amazing, but your login flow is a cursed maze.”

If you only track overall sentiment, you’ll miss that customers are praising the core value while quietly bleeding out in a specific step.

Aspect-based sentiment is the practical upgrade herebreak comments into topics like “pricing,” “shipping,” “setup,” “support,” and “performance.”

That’s how you avoid the classic mistake of redesigning the entire product when the real villain is a single confusing screen.

3) The best insights come from combining text with context

A retailer might see “shipping” as the top negative theme. Helpfulbut not actionable enough. Add metadata (region, carrier, delivery window,

product category) and suddenly the story sharpens: negativity clusters in one region, after a specific warehouse handoff, for oversized items.

Now the fix is operational, not existential. This is why a lightweight data standardchannel, touchpoint, date, segmentpays off quickly.

4) Your sentiment program works when teams can’t ignore it

Dashboards are nice, but they can become “that thing we admire once a quarter.” What changes behavior is when sentiment is operational:

alerts for sudden negative spikes, weekly summaries by topic, and a clear owner for each driver. One effective pattern is a simple loop:

detect a theme (e.g., “billing confusion”), assign an owner (billing ops), ship a fix (clearer invoice wording), and monitor whether sentiment improves.

When teams see the needle move, the program becomes self-fundingbecause it’s obviously useful.

5) Customers notice when you act on feedback (and they reward you)

The most underrated “sentiment tactic” is closing the loop. If a customer complains about a confusing policy and later receives a note like,

“We updated our help article and checkout language based on your feedback,” you’ve done two things: improved the experience and built trust.

It also increases future response rates because customers learn their words matter. In practice, this can turn sentiment analysis from

a back-office analytics project into a visible part of your brand promise: “We listen. Then we fix things.”