Table of Contents >> Show >> Hide

- The 3 Main Ways to Send Money from Gambia to the US

- Before You Send: The 5 Things That Decide Cost and Speed

- Option A: Send Money from Gambia via Western Union or MoneyGram

- Option B: Send a SWIFT International Wire from a Gambian Bank to a US Bank

- Why “App-Based” Transfers Often Don’t Work from Gambia (And What to Do Instead)

- How to Save Money on Transfers (Without Doing Anything Sketchy)

- Safety and Compliance: The Boring Stuff That Protects Your Money

- Quick Checklist: What to Gather Before You Send

- Frequently Asked Questions

- Conclusion

- Real-World Experiences: What People Learn After a Few Transfers (Extra)

Sending money from The Gambia to the United States sounds like it should be as easy as tapping “Send” and watching dollars teleport.

In real life, it’s more like mailing a package: you pick the carrier, choose speed vs. cost, fill out the label correctly, and (please) don’t

ship it to “My Cousin, Somewhere in America.”

The good news: you have reliable options. The “best” method depends on what matters mostspeed, total cost, convenience for the receiver, or

whether your recipient needs cash pickup or a bank deposit.

The 3 Main Ways to Send Money from Gambia to the US

1) Money transfer operators (cash pickup or bank deposit)

This is the classic route: you go to an agent location in The Gambia, pay (often in cash), and your recipient receives money in the US either

as cash pickup or (sometimes) directly into a bank account. This tends to be the easiest option when the sender doesn’t want to deal with bank

wire paperworkand when the receiver wants cash fast.

2) Bank-to-bank international wire (SWIFT)

If you have a bank account in The Gambia, your bank can usually send an international wire to a US bank using the SWIFT network.

This option is common for larger amounts (tuition, invoices, savings transfers) and for situations where the recipient wants the funds deposited

straight into a US account.

3) “Digital-only” services (often limited for Gambia-based senders)

Many popular app-based remittance services are designed for senders in the US, UK, EU, or other supported countriesnot always for residents in

The Gambia. Some platforms let you send to Gambia easily, but the reverse direction may be restricted. So: great in theory, sometimes

not available in practice.

Before You Send: The 5 Things That Decide Cost and Speed

- Delivery method: cash pickup is often fastest; bank deposit can be cheaper for larger amounts.

- Fees: providers may charge a transfer fee, plus additional fees for certain payment or payout options.

- Exchange rate markup: the “rate you get” may be different from the mid-market rate; that difference can be the biggest cost.

- Transfer time: “minutes” is possible for cash pickup; wires usually take 1–5 business days.

- Compliance checks: larger transfers can trigger identity checks and questions about the purpose/source of funds.

Option A: Send Money from Gambia via Western Union or MoneyGram

When this option makes sense

- You want a widely available agent network.

- Your recipient may need cash pickup in the US.

- You want a simple process: show ID, fill out a form, pay, track.

What you’ll typically need (sender side)

- Valid government-issued ID (required for many transfers, especially above certain amounts).

- Recipient details: full legal name (exactly as on their ID), city/state, phone number (recommended).

- Payout preference: cash pickup vs. bank deposit (if available for your corridor).

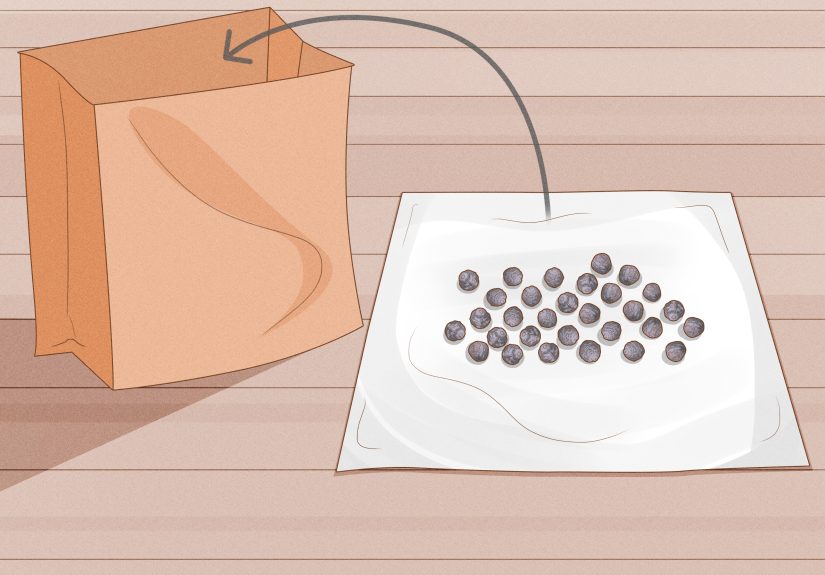

Step-by-step: sending from an agent location

-

Choose your payout type: If your receiver needs cash, pick cash pickup. If they prefer a bank deposit, ask the agent if it’s

available for the US corridor. -

Bring the right information: The #1 cause of transfer drama is a name mismatch. “Mike” on the form and “Michael” on the ID can

turn “minutes” into “please call customer support.” -

Ask for the total cost breakdown: Confirm the transfer fee and the exchange rate being used (and whether the receiver gets USD

or a converted amount). -

Pay and keep your receipt: Save the tracking/reference number. Screenshot it. Email it to yourself. Tattoo it on a sticky note

(joking… mostly). - Tell the recipient what they need: For cash pickup, they’ll usually need the reference number and matching ID.

Realistic examples (with the “hidden” math)

Let’s say you’re sending the equivalent of $200.

Your total cost can include: (1) a transfer fee, plus (2) the exchange rate markup.

Even if the fee looks small, the rate difference can quietly take a bite out of the amount received.

For example, if your transfer fee is modest but the exchange rate is a little less favorable than the mid-market rate, the “true cost” might be

closer to buying a fancy coffee than you expectedexcept the coffee is invisible and you can’t even enjoy it.

Option B: Send a SWIFT International Wire from a Gambian Bank to a US Bank

When a wire transfer is the better move

- You’re sending a larger amount (tuition, medical bills, business payments).

- You want funds deposited straight into a US bank account.

- You’re okay with a bit more paperwork for potentially cleaner delivery.

What information you need from the US recipient

US banks typically require specific identifiers for wires. Ask your recipient to send you their bank’s official wire instructions (from their bank

app/website or customer support), not a random screenshot from 2017.

- Recipient name (as it appears on the bank account)

- Recipient account number

- US bank name and address (often required on wire forms)

- SWIFT/BIC code for the receiving US bank (for international wires)

- ABA routing number (a 9-digit US bank identifier often needed for wire routing)

- Purpose of payment (tuition, family support, invoice payment, etc.)

Examples of how US banks describe incoming wire requirements

Different US banks publish slightly different instructions, but they generally boil down to “give the sender our SWIFT/BIC and your account number,”

and sometimes an ABA (routing) number too. Your recipient can find these instructions in their bank’s wire transfer FAQ/help pages.

How long will a wire take?

International wires often land in 1–5 business days. Delays can happen due to time zones, weekends, missing information, or

intermediary (correspondent) banks involved in the route.

Wire transfer fees: what people forget to budget for

- Sending bank fee in The Gambia

- Intermediary bank fees (sometimes deducted along the way)

- Receiving bank incoming wire fee (varies by US bank/account type)

- Currency conversion if you’re sending in a currency that gets converted to USD on receipt

Pro tip: ask your Gambian bank whether the wire will be sent as OUR (you pay fees), SHA (shared), or

BEN (beneficiary pays). The option you choose can change how much arrives in the US.

Why “App-Based” Transfers Often Don’t Work from Gambia (And What to Do Instead)

A lot of people search for a “Wise/PayPal/Xoom-style” solution because it feels modern and painless. The catch: many of these services only let you

send money to the US from selected countries, and account features can depend on where you legally reside.

- Some services only support sending to the US from certain regions (for example, limited country lists for outbound-to-US transfers).

-

Account eligibility can be residency-based. If the provider doesn’t support residents of The Gambia for holding balances or issuing

cards, you may not be able to use it as your main “from Gambia” sending method.

What to do instead: use a money transfer operator (agent-based) or a bank wire. If you personally have a bank account or legal residency in a supported

country (separate from The Gambia), then some digital services may become availablejust make sure you’re following the provider’s rules and local laws.

How to Save Money on Transfers (Without Doing Anything Sketchy)

Compare the “all-in” cost, not just the fee

The total cost is usually fee + exchange rate margin. A “low fee” transfer can still be expensive if the exchange rate is padded.

Send fewer, larger transfers (when appropriate)

If you’re sending support money every week, fees can stack up fast. Sometimes one larger transfer per month can reduce total feesassuming the recipient

can budget accordingly.

Use bank deposit when the recipient doesn’t need cash

Cash pickup is convenient, but it can be priced for convenience. If your recipient is comfortable receiving into a bank account, you may have better

pricing options (depending on provider availability).

Avoid weekends and holidays when timing matters

Banking rails love business days. If you initiate a wire late Friday, it may spend the weekend doing absolutely nothinglike a tourist sunbathing.

Safety and Compliance: The Boring Stuff That Protects Your Money

Double-check names and numbers

- Cash pickup: recipient name must match ID exactly.

- Bank wires: one wrong digit in the account number or routing info can cause delays, returns, or misapplied funds.

Watch for scams and “urgent emergencies”

Scammers love urgency: “Send it now, don’t tell anyone, it’s an emergency.” If you’re being pressured, pause. Verify through another channel.

Only send money to people you actually know and can confirm.

Sanctions screening and AML checks are normal

Banks and transfer providers may screen names and details against sanctions lists and run anti-money-laundering checks. If a transfer gets paused and

you’re asked for more info, it’s usually compliancenot personal.

Quick Checklist: What to Gather Before You Send

- Your ID (and any extra documents your provider requests for larger transfers)

- Recipient’s full legal name (match their ID/bank account)

- Recipient’s payout method: cash pickup or bank deposit

- If bank deposit: account number, bank name/address, SWIFT/BIC, and ABA routing number (as provided by the recipient’s bank)

- Reason for transfer (family support, tuition, invoice, etc.)

- Tracking/reference number after payment

Frequently Asked Questions

Is cash pickup in the US fast?

It can be very fastsometimes minutesdepending on the provider, payment method, location hours, and compliance checks. Always confirm expected delivery

time at the point of sending.

Can I send USD from Gambia directly?

Sometimes, depending on your bank/provider and how you fund the transfer. If you fund in GMD, conversion to USD is likely part of the process. Ask how

the exchange rate is set and whether the recipient receives USD or an equivalent payout.

What if my recipient doesn’t have a bank account?

Cash pickup is typically the simplest solution. Make sure your recipient knows what ID they need and where they’ll pick up the money.

What’s the biggest mistake people make?

Name mismatch and incorrect bank details. The runner-up is ignoring the exchange rate and focusing only on the fee.

Conclusion

To send money to the US from The Gambia, most people use either an agent-based money transfer service (best for speed and cash pickup) or an international

bank wire (best for larger amounts and direct bank deposits). The winning strategy is simple: pick the method that fits your recipient, confirm the

all-in cost (fee + exchange rate), and triple-check the details before you hit “send.”

Real-World Experiences: What People Learn After a Few Transfers (Extra)

After you’ve sent money across borders a few times, you start noticing patternskind of like realizing every “quick errand” takes 45 minutes.

Here are common experiences people share when sending money from The Gambia to the US, plus the practical lessons that stick.

1) The “Name Spelling” saga. One of the most frequent stories goes like this: the sender writes the recipient’s nickname or

short version of their name, the recipient shows up at pickup, and suddenly the money is “not found” or “on hold.” The fix is usually simple, but the

frustration is realespecially when you’ve promised someone, “It’ll be there in a few minutes.” People who learn this lesson once rarely repeat it.

After that, they treat legal names like passwords: exact characters, no creative flair.

2) The “cheap fee, expensive rate” surprise. A lot of first-time senders focus on the transfer fee because it’s the only cost that

looks obvious. Then they compare what they paid versus what the recipient received and feel like the math isn’t math-ing. Over time, experienced senders

start asking one key question before paying: “How much will the recipient get in USD today?” That single question forces the full cost into the open.

People also get into the habit of checking rates at different times of day and sending when the market is calmer (or at least not moving wildly).

3) The student-tuition reality check. Families sending money for tuition or living expenses often discover that bank wires feel “more

official,” but they come with extra steps. The first wire can be slow because banks may ask for documentation, and intermediaries can take fees along the

route. After a couple of transfers, families typically develop a system: the student sends official wire instructions directly from their US bank, the

sender keeps a saved template at their Gambian bank, and they initiate transfers earlier in the week to avoid weekend delays. The vibe becomes less

“panic transfer” and more “monthly routine.”

4) The small-business inventory crunch. Entrepreneurs paying US suppliers often prefer wires for larger invoices, but they learn quickly

that timing matters. A supplier might ship only after funds clear, so a one-day delay can become a one-week delay if it hits a weekend or holiday.

Experienced business owners build in buffer time and send payment earlier than feels necessarybecause it’s easier than explaining to customers why the

product is “almost here” for the third week in a row. They also request invoices with clear beneficiary details (bank name, address, SWIFT/BIC) to avoid

last-minute back-and-forth.

5) The “emergency request” test. Many people have received that alarming message: “I need money right now.” The experienced senders do

two things before sending: (1) verify through a second method (call the person, or confirm with a family member), and (2) decide the safest delivery method.

Cash pickup is fast, but it’s also hard to reverse if you send it to the wrong person. This is why seasoned senders slow down for 60 seconds, even in

emergencies. Ironically, that short pause is often what prevents a very expensive mistake.

6) The “keep every receipt” habit. People who send regularly end up with a mini-archive: photos of receipts, reference numbers, bank

confirmation pages, and messages confirming the recipient got the funds. It feels excessiveuntil something goes wrong. Then it feels genius.

The most relaxed senders aren’t the ones who “never have problems.” They’re the ones who can prove what happened, when it happened, and what details were

usedso support teams can actually help.

The bottom line from real-world experience is refreshingly unglamorous: the best transfers are the boring ones. Accurate details, clear expectations,

and a quick review of costs beat last-minute stress every time.