Table of Contents >> Show >> Hide

- What Exactly Are I Bonds?

- The “Too Good To Be True” Era of I Bond Returns

- Why I Bond Returns Look So Attractive

- The Fine Print: Why I Bonds Aren’t Perfect

- I Bonds vs Other Safe Havens for Your Cash

- Who I Bonds Are Best For Right Now

- How a Financial Samurai Might Use I Bonds

- Experience Spotlight: Living Through the I Bond Boom

- Bottom Line: Still Strong, Just Not “Free Money”

Every few years, the financial world discovers a “cheat code” a boring little

product that suddenly pays eye-popping returns with almost no risk. In 2022 and

2023, that role belonged to Series I savings bonds, better known as I Bonds. When

headlines screamed that these inflation-linked bonds were paying up to 9.62%,

cautious savers and spreadsheets everywhere started to shake with excitement.

Financial Samurai jumped on the opportunity early, walking readers through why

I Bond returns felt almost too good to be true. At a time when many bank

accounts were paying close to nothing, I Bonds were handing out equity-like

returns with Treasury-backed safety. That combination felt like the financial

equivalent of finding a perfectly ripe avocado on the supermarket discount rack.

Today, inflation has cooled and I Bond rates have come back down to earth.

Newly issued I Bonds currently offer a composite rate in the rough mid–4% range

(as of late 2025), combining a modest fixed rate with a still-solid inflation

adjustment. That’s no longer viral-on-Twitter exciting, but it’s still

competitive with many other low-risk options and comes with some unique tax and

inflation benefits.

So were those I Bond returns really “too good to be true,” or just a rare

moment when boring government paperwork beat Wall Street at its own game?

Let’s unpack how I Bonds work, where they shine, where they disappoint, and

how a Financial Samurai–style investor might use them now.

What Exactly Are I Bonds?

Series I savings bonds are U.S. government savings bonds designed to protect

your money from inflation. You buy them directly from the U.S. Treasury,

usually through the TreasuryDirect website, and you hold them in an online

account instead of a brokerage.

I Bonds are “non-marketable,” which means you can’t trade them on the open

market the way you would with a regular Treasury or a Treasury Inflation-Protected

Security (TIPS). You buy them from the government, and you redeem them back to

the government. On the plus side, they’re backed by the full faith and credit

of the United States essentially the gold standard for safety in dollar terms.

How the composite rate works

I Bond returns come from two pieces added together into one “composite rate”:

-

Fixed rate: Set on the day you buy the bond and never

changes for as long as you hold it (up to 30 years). -

Inflation rate: Adjusted every six months based on changes

in the Consumer Price Index for All Urban Consumers (CPI-U).

The Treasury combines those into a single composite rate using this formula:

Composite rate = fixed rate + (2 × inflation rate) + (fixed rate × inflation rate)

The key takeaway: when inflation spikes, the inflation component jumps and

your I Bond rate can soar. When inflation falls, the variable component drops,

and your total return moves back toward something more normal.

You earn interest monthly, and it compounds semiannually. The rate you get

applies for six months from the date you bought the bond, then resets every

six months according to the new inflation data. That’s why different I Bond

buyers often have slightly different experiences, even in the same year.

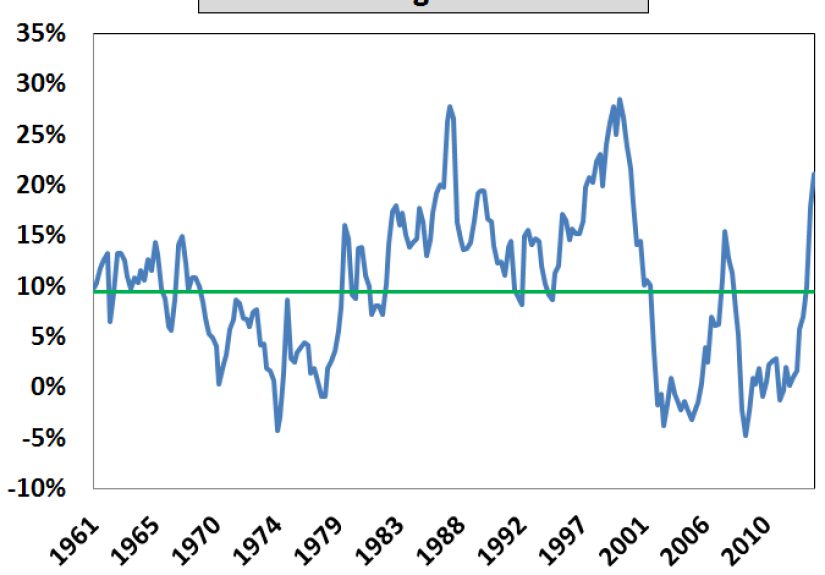

The “Too Good To Be True” Era of I Bond Returns

When inflation went wild (and I Bonds went viral)

In 2022, inflation surged to multi-decade highs. Because I Bonds are pegged to

inflation, their variable rate exploded higher too. For bonds issued between

May and October 2022, the annualized composite rate hit a headline-grabbing

9.62%. That’s not a typo: nearly double-digit returns from a U.S. government

savings bond.

Before that, bonds issued in late 2021 were already earning over 7% on an

annualized basis. Savers who had been parking cash in 0.01% checking accounts

suddenly had a safe way to earn “stock-like” returns without accepting stock

volatility. For many Financial Samurai readers, it sounded like the ultimate

low-risk hack: trade a few clicks and a TreasuryDirect login for returns that

even aggressive growth funds were struggling to beat.

No wonder the Treasury was flooded with new accounts and I Bond purchases.

Billions of dollars poured in as people rushed to lock in high inflation-linked

rates before the next reset. If you were in the personal-finance world at the

time, you probably saw I Bonds discussed everywhere blogs, podcasts, Reddit,

and yes, trending on social media.

From sizzle back to “just” solid

Of course, those sky-high returns were never meant to last. As inflation began

to cool, the inflation component of the I Bond rate also moved down. By

mid–2023, the composite rate had fallen back into the mid–4% range for new

issues still attractive, but no longer the stuff of viral screenshots.

Fast-forward to late 2025 and new I Bonds are paying a composite rate in the

general 4% neighborhood, combining:

- A fixed rate around 0.9%–1.1% locked in for the life of the bond.

- A variable inflation adjustment based on the most recent CPI data.

That’s still competitive with many savings accounts and some shorter-term

CDs, especially when you factor in the tax benefits. But it’s very different

from the 7%–9.62% “golden window” that made I Bonds feel almost unfair in

2022.

Why I Bond Returns Look So Attractive

1. True inflation protection

Unlike a typical bank account or even most CDs, I Bonds explicitly protect

you from inflation, because their variable rate is tied to CPI. When prices

are rising quickly, your I Bond rate tends to rise, too. That means your

purchasing power has a better chance of staying intact instead of quietly

eroding over time.

2. Government-backed safety

I Bonds are backed by the U.S. Treasury. If you’re worried about your bank

going under or your stock fund dropping 30% during a rough year, the idea of

a virtually risk-free asset with a historically strong inflation adjustment

looks extremely appealing.

3. Tax perks that quietly boost your real return

Another reason I Bonds feel “too good to be true” is how taxes work:

-

You don’t pay federal income tax on the interest until you cash the bond or

it matures (up to 30 years), letting the gains compound tax-deferred. -

You never pay state or local income taxes on I Bond interest, which

is a big win if you live in a high-tax state. -

In some cases, if you use I Bonds for qualified higher-education expenses

and meet income and other requirements, you may be able to exclude some or

all of the interest from federal tax as well.

When you compare I Bonds with a taxable savings account or CD in a high-tax

state, their after-tax returns can look even better than the headline numbers

suggest.

4. Automatic compounding and no reinvestment risk

With a CD or bank promo, you often have to decide what to do when the term

ends: roll it over, move it, or chase a new rate. I Bonds keep compounding

automatically for up to 30 years. You don’t have to babysit them or constantly

shop for the next teaser rate.

The Fine Print: Why I Bonds Aren’t Perfect

So far, I Bonds sound like a magic trick: high-ish yield, inflation protection,

government backing, and tax perks. But there are catches the kind of details

Financial Samurai is always quick to highlight.

1. Purchase limits

You can’t just dump your entire net worth into I Bonds. The annual purchase

limits are:

- Up to $10,000 per calendar year per Social Security number in electronic I Bonds.

-

An additional amount through certain entities (like trusts or businesses),

each with its own limit.

In the past, you could also buy up to $5,000 in paper I Bonds with your federal

tax refund, but that path has been phased out. For most people, the realistic

cap is $10,000 per person per year, maybe more if you use entities or gifts

helpful, but not portfolio-transforming if you’re managing larger sums.

2. Liquidity restrictions and penalties

I Bonds are not “instant access” money. Two key rules:

-

You cannot redeem an I Bond at all in the first 12 months.

That money is locked up, period. -

If you redeem within the first five years, you lose the last three months of

interest as a penalty.

That doesn’t make I Bonds bad, but it does mean they’re a poor fit for your

primary emergency fund. If your roof leaks next month, TreasuryDirect is not

where you want your only cash.

3. Rates go down as well as up

The same inflation link that made I Bonds shine in 2022 also means that

returns can drift lower when inflation cools. When CPI moderates, the variable

rate drops, and your total return can fall into a very normal, almost boring

range. That’s what we’re seeing today: still solid, but no longer jaw-dropping.

If you only bought I Bonds expecting 9% forever, you were chasing a moment,

not a long-term strategy.

4. The TreasuryDirect experience

Finally, we have to talk about the website. TreasuryDirect is legendary for

feeling like a time capsule from the early 2000s multiple passwords, clunky

navigation, and the occasional need to mail in forms. It has improved somewhat,

but it still isn’t as smooth as logging into a modern brokerage or banking app.

For a Financial Samurai type who is comfortable filling out forms, this is

annoying but manageable. For someone who hates dealing with government portals,

it can be a genuine barrier.

I Bonds vs Other Safe Havens for Your Cash

To decide whether I Bond returns are really “too good to be true,” you need to

compare them to the competition: high-yield savings accounts, CDs, money market

funds, and TIPS.

I Bonds vs. high-yield savings and money market funds

Online banks and money market funds often pay attractive variable rates with

daily liquidity. When short-term interest rates are high, these accounts can

yield around the same or more than I Bonds with no one-year lockup and no

penalty for withdrawals.

However, high-yield savings rates can change quickly and are fully taxable at

both federal and state levels. I Bonds, by contrast:

- Defer federal tax until redemption or maturity.

- Never incur state or local income tax on interest.

- Build in inflation protection rather than just chasing Fed policy.

Roughly speaking, I Bonds can win on after-tax, after-inflation returns over

the long run, while savings accounts win on flexibility and ease of use.

I Bonds vs. CDs

CDs usually offer:

- A fixed rate for a set term (say, 1–5 years).

- FDIC insurance up to legal limits.

- Penalties if you withdraw early.

While CDs can sometimes beat I Bond rates at a specific moment in time, they

don’t adjust for inflation. If inflation flares up unexpectedly, your CD is

stuck at its original rate, and your real return could shrink or even go

negative after inflation.

I Bonds, on the other hand, float with inflation, giving you better protection

if we hit another period like 2022.

I Bonds vs. TIPS

Treasury Inflation-Protected Securities (TIPS) are the “cousins” of I Bonds.

They also protect against inflation, but in a different way:

- TIPS are marketable and tradeable; their prices can go up and down.

-

The principal value of a TIPS bond adjusts with inflation, and interest is

paid on that adjusted principal. -

You’re exposed to interest-rate risk if market yields rise, your TIPS

price can fall in the short term.

I Bonds avoid that mark-to-market volatility. Your principal doesn’t fluctuate

with market rates; you just see a changing interest rate over time. You also

get more flexible tax timing with I Bonds, since you can defer federal tax

until redemption, while TIPS interest is typically taxable each year.

In a Financial Samurai framework, it’s reasonable to think of I Bonds as a

more conservative, easier-to-manage inflation hedge, and TIPS as the more

flexible but more complex cousin that fits better inside a diversified bond

portfolio or retirement account.

Who I Bonds Are Best For Right Now

With rates back down from the 9.62% fireworks, the question becomes: Are I

Bonds still worth it? For many people, the answer is “yes, but for a

specific role.”

-

Long-term savers who hate inflation: If watching your cash

lose purchasing power keeps you up at night, I Bonds are a great antidote. -

Tax-conscious investors: State-tax-free interest and

federal tax deferral make I Bonds especially attractive in higher brackets. -

Parents planning for college: Used correctly, I Bonds can

help fund education with potential additional tax advantages. -

People building a “laddered” safety bucket: A mix of

high-yield savings for immediate access, I Bonds for inflation-protected

long-term safety, and maybe CDs or TIPS for diversification can work very

well together.

Where I Bonds are less ideal:

- As your only emergency fund.

- As a speculative trade the days of easy 9%+ are gone, at least for now.

-

As a home for very large balances, due to purchase limits and the hassle of

managing multiple entities.

How a Financial Samurai Might Use I Bonds

The original Financial Samurai take on I Bonds blended enthusiasm with realism:

they were a fantastic opportunity for a limited time, but never a complete

portfolio solution. That mindset still applies.

A Samurai-style approach might look like this:

-

Max out annual I Bond purchases for you (and possibly your spouse, trust, or

business) when the composite rate is clearly attractive relative to other

safe options. -

Treat I Bonds as part of your “safe” bucket, alongside Treasuries, CDs, or

cash, rather than as a replacement for equities or growth assets. -

Use the inflation protection and tax deferral to quietly improve your real

long-term returns, while your riskier assets do the heavy lifting for

growth. -

Stay flexible. As rates, inflation, and your own goals change, it’s okay to

slow or pause I Bond purchases and redirect new contributions elsewhere.

In other words, I Bonds can be a sharp tool in your financial toolkit but

they’re still just one tool. The real power comes from how you combine safe

assets, growth assets, and income strategies into a coherent plan.

Experience Spotlight: Living Through the I Bond Boom

To see how this plays out in real life, imagine an investor named Alex who

closely followed Financial Samurai during the I Bond mania years.

In late 2021, Alex was sitting on a big pile of cash after selling a rental

property. The proceeds landed in a savings account earning basically nothing,

and inflation headlines were everywhere. Groceries, gas, and home repairs

were all getting more expensive. Alex felt like every month of leaving that

money in cash was the financial equivalent of watching dollar bills slowly

evaporate.

Then the news hit: Series I savings bonds were offering over 7% with the

possibility of even higher rates coming and they were backed by the U.S.

government. Alex read a detailed breakdown from Financial Samurai and cross-checked

it against other reputable sources. The conclusion was clear: this wasn’t some

exotic product or crypto scheme. It was a straightforward inflation-hedged

bond the Treasury had offered for years. The only thing that had changed was

inflation itself.

Alex decided to act, but not recklessly. Instead of dumping the entire property

windfall into I Bonds, Alex:

- Bought $10,000 of I Bonds for themself.

- Encouraged their spouse to do the same.

-

Kept several months of living expenses in a high-yield savings account for

genuine emergencies. -

Used the remaining cash to dollar-cost average into a diversified portfolio

of index funds.

Over the next year, those I Bonds delivered exactly what the headlines promised:

high, inflation-linked returns with no day-to-day volatility. Meanwhile, the

stock market had a rocky stretch, and some of Alex’s equity positions were

temporarily underwater. Seeing the I Bonds quietly compounding above 7%, then

above 9%, made it psychologically easier for Alex to stick with the equity

plan and not panic-sell during turbulence.

By 2023, the composite rate on new I Bonds had fallen. Alex stopped treating

I Bonds like a once-in-a-lifetime opportunity and went back to viewing them

as a good, but not dominant, part of the safety bucket. The existing bonds

kept adapting to new inflation data, and Alex was comfortable holding them for

years, or even decades, letting inflation protection and tax deferral quietly

do their job.

A few key lessons came out of Alex’s experience:

-

Good deals are often temporary. The 9.62% era was a

product of extraordinary inflation, not some permanent new normal. Alex

treated it like a bonus, not a baseline. -

Liquidity matters. Alex avoided the temptation to put all

emergency cash into I Bonds. When the car needed repairs and a medical bill

hit in the same month, that liquid savings account did exactly what it was

supposed to do. -

Psychology is part of your return. Knowing that a slice of

the portfolio was earning strong, low-risk returns helped Alex stay calmer

about the parts that were temporarily down. -

Process beats prediction. Instead of trying to time every

rate change, Alex followed a simple process: max out I Bond purchases in

years when the composite rate looked clearly attractive, keep enough cash

liquid, and continue investing regularly in long-term growth assets.

That’s exactly the sort of balanced, long-horizon mindset that Financial Samurai

often emphasizes: use opportunities, but don’t bet the farm on any single

product or moment in time.

Bottom Line: Still Strong, Just Not “Free Money”

I Bond returns absolutely did feel almost too good to be true during

the height of the inflation surge. For a brief period, you could get

stock-like returns from a government-backed bond with built-in inflation

protection and friendly tax treatment. That window may never look quite the

same again.

But that doesn’t mean I Bonds are suddenly irrelevant. Today, with more normal

inflation and mid-single-digit composite rates, they still offer:

- Solid, low-risk returns.

- Protection against future inflation surprises.

- Tax advantages that quietly boost your real yield.

-

A helpful psychological anchor in a portfolio that also includes stocks,

real estate, or other riskier assets.

Are I Bond returns “too good to be true”? Not anymore and that’s okay.

They’re not magic. They’re simply one of the most elegant tools the U.S.

Treasury has ever offered for savers who care about safety and

purchasing power. Used thoughtfully, in true Financial Samurai fashion, they

can help you protect your hard-earned money while the rest of your portfolio

goes to battle.