Table of Contents >> Show >> Hide

- What “International Business Transfers” Actually Includes

- How International Wires Work (and Why Fees Feel Like a Magic Trick)

- Compliance Isn’t Optional: KYC, AML, and Sanctions Screening

- The Risk You’re Really Managing

- Managing FX Risk Without Turning Into a Full-Time Currency Trader

- Choosing a Provider: Bank vs Fintech vs Payment Platform

- Fraud-Proofing Your International Payments

- A Repeatable Workflow: From Invoice to Reconciliation

- Common Mistakes That Cost Real Money

- Conclusion: Make Global Payments Boring (That’s a Compliment)

- Experiences & Field Notes: What Businesses Learn the Hard Way (So You Don’t Have To)

- 1) The “exact amount” trap

- 2) “FX isn’t a problem”… until it is

- 3) Cutoff times are the silent killer of “urgent” payments

- 4) Compliance holds feel randomuntil you see the pattern

- 5) Vendor bank changes are where fraud loves to live

- 6) Reconciliation pain is a sign your payment stack is messy

- 7) The “best” setup is the one you can repeat

Paying an overseas supplier shouldn’t feel like launching a rocket… yet sometimes it does. One minute you’re approving an invoice,

the next you’re decoding SWIFT codes, wondering why “OUR/SHA/BEN” sounds like a boy band, and praying the money doesn’t take a

sightseeing tour through three intermediary banks.

This guide breaks down how international business money transfers really work, what they cost, where risks hide, and how to manage

them with practical controlsso your payments move on purpose, not on vibes.

What “International Business Transfers” Actually Includes

“Send money internationally” can mean several very different rails and workflows. The best option depends on your priorities

(speed, certainty, fees, FX rate, and compliance).

Common transfer types

- International wires (SWIFT): High certainty, widely available, great for larger paymentsoften higher fees and less transparency around intermediary deductions.

- Local bank transfers via a provider: Some banks/fintechs pay out locally in the destination country, which can reduce fees and improve delivery speed.

- ACH and faster payments (domestic legs): Even “international” payments often begin with a domestic bank transfer before conversion and payout.

- Card and payment processor methods: Useful for online commerce and smaller amounts, but fees and FX can stack up fast.

The “right” choice is less about picking a single provider and more about building a payment stack: wire capability for high-value

supplier payments, local payouts for recurring vendor runs, and card/processor rails for ecommerce or platform payouts.

How International Wires Work (and Why Fees Feel Like a Magic Trick)

International wires typically use the SWIFT messaging network to send standardized payment instructions between banks. The money may

move through correspondent or intermediary banks when the sending and receiving banks don’t have a direct relationship.

That’s normalbut it’s also where surprise fees and delays can appear.

Where costs show up

- Sending bank fees: Your bank may charge an outgoing wire fee.

- FX spread / markup: If you convert currency, the exchange rate can include a margin.

- Intermediary bank fees: One or more banks in the middle may deduct fees en route.

- Receiving bank fees / lifting fees: The beneficiary bank may deduct fees before crediting the recipient.

The big lesson: if the recipient must receive an exact amount (common for tuition, customs, or contract-required payments), you need

to plan for deductions. For vendor invoices, misalignment here can trigger “short paid” disputes and shipping delaysmeaning your

payment risk turns into supply-chain risk. Fun!

Timing: why “today” sometimes means “after three holidays and a goat market”

Even when the instructions move instantly, delivery time depends on cutoffs, time zones, local banking hours, and required compliance

checks. International wires are often measured in business days, not minutes. Build buffer time for: destination holidays, name

screening reviews, and beneficiary bank processing.

Compliance Isn’t Optional: KYC, AML, and Sanctions Screening

Cross-border payments sit at the intersection of commerce and financial crime prevention. That’s why banks and payment providers

ask for documentation and sometimes pause payments that look unusual. It’s not personal; it’s the system doing its job (and trying

not to get fined into a different universe).

What businesses should expect

- Identity and business verification (KYC): ownership, control persons, and business activity information.

- Transaction monitoring (AML): unusual patterns can trigger questions or holds.

- Sanctions screening: names, countries, banks, and even shipping documents can be screened against sanctions lists.

- Recordkeeping: invoices, contracts, and proof of goods/services can be requestedespecially for higher-risk corridors.

Practical tip: standardize your “payment packet.” For each international payment, keep a folder (or structured ticket) with the

invoice, purchase order, contract terms, and the business purpose of payment. If a provider asks questions, you answer in minutes,

not days.

The Risk You’re Really Managing

International payments are less like “click send” and more like “manage four risks at once.” Here’s the playbook.

1) FX risk (foreign exchange risk)

FX risk is the chance that exchange rates move between the time you agree on a price and the time cash actually changes currencies.

It shows up most often in:

- Transaction exposure: you owe (or will receive) a fixed foreign-currency amount in the future.

- Cash-flow exposure: recurring purchases, subscriptions, or payouts in foreign currency.

- Margin exposure: you price in one currency but pay costs in another.

2) Payment execution risk

Wrong beneficiary details, incorrect bank codes, missing intermediary instructions, or a mismatched beneficiary name can trigger

returns, investigations, or “limbo” status while banks query each other. Execution risk is boringuntil it’s expensive.

3) Compliance risk

Payments linked to sanctioned parties, restricted goods, or prohibited jurisdictions can be blocked. Even accidental matches (like a

common name similar to a sanctioned entity) can cause delays while a bank reviews and clears it.

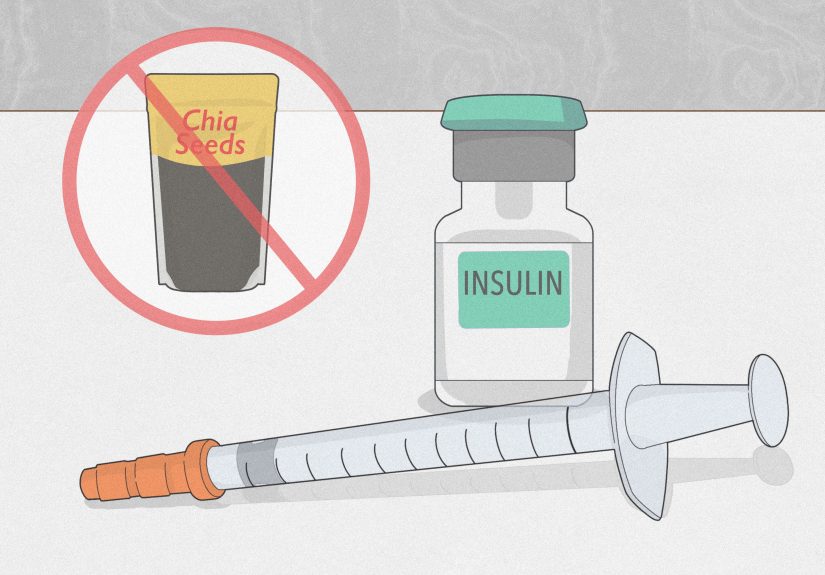

4) Fraud risk (especially Business Email Compromise)

Business Email Compromise (BEC) is the classic “vendor emailed new bank details” scam. It’s effective because it targets processes,

not passwords. Your defense is workflow design: verification, approvals, and separation of duties.

Managing FX Risk Without Turning Into a Full-Time Currency Trader

You don’t need to predict the euro or become “that person” who talks about charts at lunch. You need a policy that reduces surprises,

protects margins, and fits your business model.

Start with exposure mapping

- List your foreign-currency payables and receivables by currency and due date (30/60/90+ days).

- Identify your “must pay” versus “flexible timing” flows.

- Measure your true margin at risk (not just the invoice amount).

Practical hedging tools (most common in corporate treasury)

-

Natural hedging: match inflows and outflows in the same currency. Example: if you sell in EUR and buy raw materials in EUR,

keep EUR balances to pay suppliers instead of converting twice. -

Netting: for multi-entity businesses, offset internal receivables/payables across subsidiaries to reduce the amount you

convert externally. - Forward contracts: lock an exchange rate for a future date. Great for known invoices and predictable payables.

- Options: pay a premium for the right (not obligation) to exchange at a set rateuseful when amounts/timing are uncertain.

- Layered hedging: hedge a portion now and add coverage as certainty increases (instead of betting everything on one date).

A simple policy template (that many finance teams actually use)

- Hedge 70–90% of committed exposures (signed contracts, issued POs) within the next 90 days.

- Hedge 0–50% of forecast exposures (expected sales/purchases) depending on predictability.

- Review exposure weekly (high volume) or monthly (lower volume).

- Track results against a benchmark rate and your protected margin.

The point isn’t to “win” against the market. The point is to keep pricing stable and protect your operating planso FX doesn’t

ambush your quarter like a surprise pop quiz.

Concrete example: importing inventory in USD while selling in CAD

If you sell in CAD but pay U.S. suppliers in USD, a strengthening USD can squeeze margins. A clean approach is to:

(1) forecast USD payables for the next 60–90 days,

(2) lock part of that with forwards,

(3) adjust product pricing rules if the protected rate moves outside tolerance bands.

This creates a loop between treasury and pricingwhere risk management actually pays rent.

Choosing a Provider: Bank vs Fintech vs Payment Platform

You’re not just buying a transfer. You’re buying reliability, compliance support, dispute handling, and predictable costs.

When a traditional bank shines

- Large, high-value wires that require strong controls and documentation.

- Complex beneficiary requirements (intermediary details, specific instructions, structured payment fields).

- Integrated treasury services (cash management, liquidity, reporting).

When fintech or payment platforms can be better

- Frequent recurring payments where local payout rails reduce cost.

- Needing multi-currency accounts to hold balances and avoid repeated conversions.

- API-based automation for marketplaces, platforms, or global contractor payouts.

Provider checklist (print this, tape it near approvals, become a legend)

- FX transparency: Can you see the rate and margin?

- Fee predictability: Are intermediary fees common in your corridors?

- Payment tracking: Can you track status and confirmations?

- Compliance support: Do they help with documentation and screening?

- Settlement speed: What’s typical by corridor and method?

- Limits and controls: Dual approvals, role-based permissions, audit logs?

- Reconciliation: Do you get clean reports for accounting?

Fraud-Proofing Your International Payments

If you move money internationally, someone will eventually try to trick you into moving it to them instead. That’s not pessimism

that’s just the internet doing internet things.

Non-negotiable controls

- Call-back verification: any change to bank details must be verified via a known phone number (not the one in the email).

- Two-person approval: one person creates the payment, another approves it.

- Vendor master lock: restrict who can edit vendor banking data; log every change.

- Payment templates: reduce manual entry for recurring vendors; fewer typos, fewer reroutes.

- Urgency filter: “pay in 30 minutes or the shipment explodes” is a red flag, not a KPI.

If fraud happens: move fast

Time matters. If you suspect a fraudulent wire, contact your bank immediately and file a report with the appropriate channels.

The faster you act, the better the chances of recovery or interruption.

A Repeatable Workflow: From Invoice to Reconciliation

The easiest way to reduce risk is to make the process boringpredictable, documented, and automated where possible.

Step-by-step payment run

- Intake: invoice + PO/contract + delivery terms + due date + currency.

- Validate vendor data: beneficiary name matches bank records; confirm SWIFT/BIC, IBAN (where required), routing details.

- Choose rail: wire vs local payout vs platformbased on urgency, size, and corridor.

- Lock FX (if needed): apply your policy (spot, forward, layered hedge).

- Approve: dual control + threshold rules (higher amounts require higher approval).

- Send and track: capture confirmations and reference numbers; track status through completion.

- Reconcile: match confirmation to invoice; account for FX gains/losses and bank fees.

- Post-mortem (lightweight): note any delays, fees, or data issues to improve templates.

Over time, this becomes a self-improving system: fewer payment errors, less FX surprise, faster approvals, and cleaner month-end close.

Your accountant may even smile. (Don’t alarm themthis is normal.)

Common Mistakes That Cost Real Money

- Confusing “send” currency with “receive” currency: the supplier expects EUR but you sent USD and they ate a conversion fee.

- Ignoring intermediary fees: the invoice was paid “short” and the vendor holds the shipment.

- Hedging too late: you hedge after the currency movedcongrats, you insured the house after the fire.

- No policy: different teams use different providers and rates; finance can’t forecast cash accurately.

- Single-person control: the easiest way to lose money quickly is to let one person create and approve wires.

- Weak vendor-change controls: BEC scams love “new bank details” emails.

Conclusion: Make Global Payments Boring (That’s a Compliment)

International business money transfers don’t have to be mysterious. When you understand the rails, price the full cost (fees + FX),

and design a repeatable workflow with clear approvals, the chaos drops dramatically.

The goal isn’t just “send money.” It’s: send money predictably, protect margins,

and reduce operational and compliance surprises. Do that consistently and your international payments become

infrastructurequiet, reliable, and pleasantly unexciting.

Experiences & Field Notes: What Businesses Learn the Hard Way (So You Don’t Have To)

The most useful lessons about cross-border payments don’t come from glossy brochures. They come from the moment someone says,

“Wait… why did the supplier receive less?” or “Why is this payment ‘under review’?” or the classic,

“The CEO emailed me to wire $48,000 urgently.” (Spoiler: the CEO did not.)

1) The “exact amount” trap

Many teams assume the invoice amount is the amount the vendor receives. But intermediary and receiving bank fees can quietly reduce

delivery. A common fix is simple: for vendors that require exact receipt, specify payment instructions clearly (including who bears

fees) and keep a buffer policy. Some businesses intentionally send slightly more to cover expected deductions; others shift to local

payout rails where the provider can quote a guaranteed delivered amount. The key is agreeing on the rule before the first shipment

is stuck in a warehouse because “payment was short.”

2) “FX isn’t a problem”… until it is

Businesses often ignore FX when volumes are small. Then they scale, the amounts grow, and one currency move wipes out a month of

profit. The turning point is usually when leadership asks why revenue is up but margins are down. The fix isn’t panic-hedging.

It’s creating a lightweight FX policy tied to exposure: hedge what’s committed, consider partial coverage for forecasts, and review

regularly. The first month you can predict cash needs without crossing your fingers is the month you stop treating FX like weather.

3) Cutoff times are the silent killer of “urgent” payments

Urgent international transfers routinely collide with banking cutoffs and time zones. Finance teams learn to build a “deadline map”:

if approvals happen after a certain hour, the payment effectively starts tomorrow. The practical improvement is to set internal

cutoffs earlier than the bank’sand to pre-approve vendors and templates so “urgent” doesn’t mean “we’re typing IBANs in a hurry.”

4) Compliance holds feel randomuntil you see the pattern

“Why did this payment get flagged?” is a common question. Over time, teams notice patterns: new counterparties, unusual amounts,

vague payment purposes, high-risk geographies, or beneficiary names that trigger false matches. The best operators preempt this by

using consistent, descriptive payment purposes (e.g., “Invoice 1042 – machine parts per PO 7781”), keeping invoices accessible, and

responding quickly when a provider requests documentation. A good process turns compliance from a blocker into a predictable step.

5) Vendor bank changes are where fraud loves to live

Real businesses get spoofed. Often. The scam is boringly effective: an email claims the vendor has “new banking details,” and it

looks legitimate because the attacker copied a real invoice. Teams that avoid losses treat bank changes like a high-risk event:

they require call-back verification, dual approvals, and a waiting period before first payment to a new account. Some even send a

$1 test payment or require written confirmation via an established portal. It’s not paranoiait’s process.

6) Reconciliation pain is a sign your payment stack is messy

If your accounting team spends days matching bank lines to invoices, you probably have inconsistent references, mixed providers, or

unclear fee handling. The fix is operational: standardize reference fields, require invoice numbers in payment descriptions, and

centralize reporting (even if you use multiple rails). Great payment operations don’t just move moneythey produce clean data.

7) The “best” setup is the one you can repeat

The most successful finance teams don’t chase perfection. They chase repeatability: a small set of rails, clear rules, templates,

and controls. That’s what scales internationally without adding chaos. Because if global growth is your strategy, your payment

process can’t be a weekly improvisation session.

Bottom line: treat cross-border payments like infrastructure. Build it once, monitor it, improve it. Your future self will be

gratefuland your suppliers will stop emailing “any update???” in all caps.