Table of Contents >> Show >> Hide

If you felt like the first half of 2022 punched your portfolio in the face and then stole your lunch money, you weren’t imagining things.

For many investors, those six months were the most painful stretch they’d ever seen: stocks down hard, bonds down hard, crypto in freefall, and “safe” portfolios suddenly not feeling so safe.

Commentators quickly called it “the worst six months ever for financial markets.” That’s a bit dramatic (markets have seen some truly apocalyptic periods),

but it was an historically awful combination of losses across multiple asset classes. The real question is:

what actually happened, how unusual was it, and what can a rational, long-term investor learn from it?

In the spirit of “a wealth of common sense,” let’s zoom out. We’ll unpack why those six months were so brutal, how they compare to past crashes,

and what smart investors did (and should do) when everything seems to be going wrong at once.

What Made These Six Months So Brutal?

A Perfect Storm of Inflation, Interest Rates, and Uncertainty

The story of that painful half-year starts with one word: inflation. After years of low and stable prices, inflation surged to levels not seen in four decades.

Everyday life got more expensivegas, groceries, rent, you name it. Central banks, especially the Federal Reserve, had one main tool to fight it:

aggressive interest rate hikes.

Those higher rates hit financial markets on multiple fronts:

- Stocks became less attractive as future earnings were discounted at higher rates.

- Bonds, which usually act as a cushion, saw prices fall as yields jumped.

- High-growth tech and speculative assets felt the most pain, as their value depends heavily on far-off future profits.

Add in the economic fallout from the war in Ukraine, ongoing supply chain disruptions, and constant recession chatter, and you had a textbook “risk-off” environment.

Stocks Tanked But That Part Wasn’t Entirely New

U.S. stocks, represented by the S&P 500, dropped more than 20% from their early-January 2022 peak during that first six-month stretch.

It was the steepest first half of a year since the 1970s and firmly in bear market territory. Global stocks didn’t fare much better:

developed and emerging markets sold off as investors reassessed growth, profits, and geopolitical risk.

Big drawdowns like this aren’t fun, but they’re not unprecedented. We’ve seen similar or worse damage in:

- The dot-com bust (early 2000s), when tech stocks crashed after years of speculative excess.

- The global financial crisis (2007–2009), when the entire banking system was under threat.

- The Covid crash (early 2020), when markets fell more than 30% in a matter of weeks.

What made this period feel different wasn’t just the size of the stock market drop. It was what didn’t work while stocks were falling.

When “Safe” Bonds Got Hurt Too

In a typical downturn, bonds are the comforting adult in the room. Stocks panic; bonds stay calm.

That relationship is the entire logic behind the classic 60/40 portfolio60% stocks for growth, 40% bonds for stability.

But in that brutal six-month window, bonds didn’t quietly protect you. They took a beating of their own.

Major bond indexes posted some of the worst returns in their history as yields spiked higher.

For many investors, it was the first time they’d seen “low-risk” bond funds fall by double digits in such a short period.

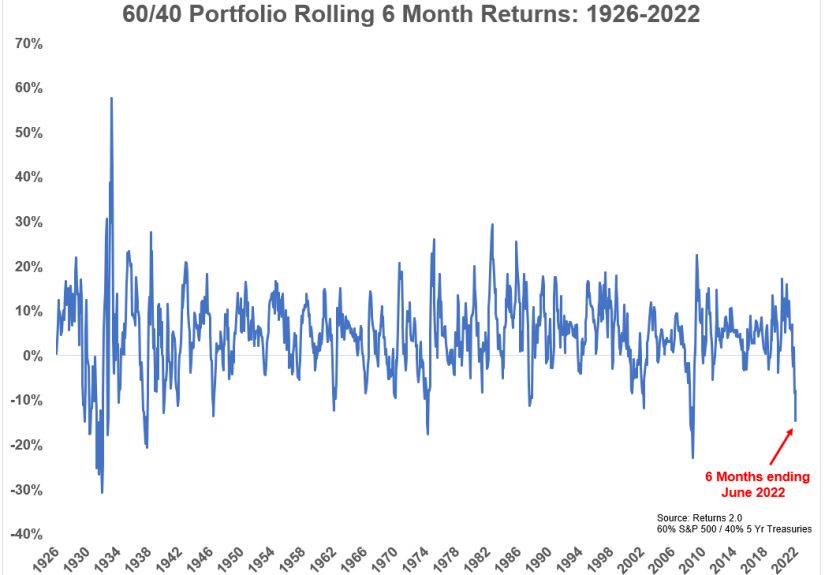

The result? Balanced portfolios that were supposed to smooth the ride had one of their worst starts on record.

For long-time 60/40 investors, it was a true “wait, this isn’t how it’s supposed to work” moment.

Why This Period Felt So Different From Past Bear Markets

Correlation Went Against the Script

For decades, one of the comforting features of markets was that stocks and high-quality bonds often moved in opposite directions.

When stocks dropped, bond prices typically rose, softening the blow. That negative correlation was the secret sauce of diversified portfolios.

During this “worst six months” stretch, the script flipped:

- Stocks sold off as investors worried about earnings, growth, and valuations.

- Bonds sold off as interest rates jumped to fight inflation.

- Even some alternative assets, like real estate and high-yield credit, struggled as financing costs rose.

When everything falls together, diversification feels like a bad joke. You don’t see the usual “winners” in your portfolio gridjust a list of different ways to lose money.

The Headlines Were Relentlessly Negative

Financial headlines didn’t help. Every day brought a fresh round of scary phrases:

- “Worst first half for stocks in decades”

- “Bond market’s worst year ever”

- “60/40 is dead”

- “Recession odds surge as Fed stays hawkish”

For investors who had never lived through the stagflationary 1970s or the chaos of the Great Depression, it truly felt like uncharted territory.

The combination of high inflation, rapidly rising rates, and synchronized losses across assets made that six-month window feel uniquely bad,

even if history shows other periods that were deeper or longer.

A Wealth of Common Sense: Putting the “Worst 6 Months” in Context

Horrible Six-Month Stretches Are More Common Than You Think

If you look at rolling six-month returns for stocks over the last century, you’ll see a pattern:

markets are frequently volatile in the short term, but remarkably resilient in the long term.

There have been many six-month windows with double-digit lossesduring wars, recessions, banking crises, bubbles bursting, and pandemics.

The unique pain of this recent period came from bonds joining the party on the downside.

But even there, longer-term data shows that balanced portfolios have historically recovered after ugly episodes.

The “worst six months” very rarely stay the worst moment in your investing life if you keep going.

Short-Term Pain, Long-Term Payoff

Historical return data for U.S. stocks shows something important:

- Over one-year periods, returns swing wildlybig gains and big losses.

- Over 10- or 20-year periods, stocks have overwhelmingly delivered positive real returns.

Bonds, meanwhile, tend to look boring over very long periodsbut that’s the point.

Their job is to provide income and stability, not excitement. Even though 2022 was a historically bad year for bonds,

higher yields that followed actually improved future return potential for new and reinvested money.

In other words, what felt like “the end of the world” for bonds may end up being the starting point for better long-term outcomes.

The 60/40 Portfolio: Bruised, Not Broken

The classic 60/40 portfolio took a big hit during that six-month stretch and the full year that followed.

But if you zoom out over many decades, 60/40 has delivered:

- Moderate volatility compared with all-equity portfolios.

- Solid long-term real returns.

- Drawdowns that, while painful, have historically been followed by recoveries.

Some investors and commentators declared 60/40 “dead.” Yet in the years after the 2022 shock, calmer inflation and more normal interest rates

have allowed balanced portfolios to recover and even outperform more complex strategies at times.

The lesson? Don’t call the time of death on a strategy after its worst six months. That’s usually when its future returns quietly improve.

How Smart Investors Survive a “Worst Six Months Ever”

1. Build a Plan Before the Storm Hits

The middle of a crash is the worst possible time to design your investment plan.

When your emotions are screaming at you to “do something,” your decisions will rarely be rational.

A better approach:

- Define your goals: retirement, a future home, kids’ education, financial independence, etc.

- Match risk to time horizon: more stocks for distant goals, more bonds and cash for near-term spending.

- Set rebalancing rules so you buy what’s gone down and trim what’s gone up, without overthinking every move.

When the next “worst six months ever” shows upand it will, eventuallya written plan gives you something sturdier than headlines to hold onto.

2. Diversify Like You Actually Mean It

Diversification isn’t just owning a handful of different stocks and a bond fund.

True diversification spreads risk across:

- Different regions (U.S. and international markets).

- Different asset classes (stocks, government bonds, corporate bonds, cash, sometimes real estate or alternatives).

- Different sectors and styles (growth, value, small caps, large caps).

Even in a period when both stocks and bonds are falling, not everything behaves the same way.

Some markets fall less. Some sectors hold up better. Some asset classes recover faster.

A sensible mix doesn’t guarantee short-term comfort, but it dramatically improves long-term survivability.

3. Respect Inflation and Interest-Rate Risk

One of the loudest messages from that brutal six-month window was this:

inflation and interest-rate risk mattersometimes more than we remember.

For years, investors got used to near-zero interest rates and modest inflation.

That environment rewarded risk-taking and made bonds look sleepy but safe.

When rates shot higher, that illusion dissolved. Suddenly, duration (interest-rate sensitivity) and inflation exposure

were no longer boring technical detailsthey were front-page drivers of returns.

Going forward, thoughtful investors are:

- Paying more attention to how sensitive their bond holdings are to rate changes.

- Balancing fixed-rate bonds with other income sources or inflation-linked securities where appropriate.

- Recognizing that “low risk” doesn’t mean “no risk.”

4. Manage Behavior, Not Just Portfolios

Almost every long-term investor knows the right answer intellectually:

“Stay the course. Don’t sell at the bottom. Think long term.”

The problem is doing that when your account balance is falling week after week.

Behavioral discipline is a superpower during awful periods. Tactics that help:

- Automate contributions so you’re buying more at lower prices without overthinking it.

- Avoid obsessively checking your accounts during highly volatile stretches.

- Use a simple checklist before making big moves: “Has my time horizon changed? Has my risk tolerance permanently changed? Or am I just scared today?”

The investors who made it through that nasty six-month window in reasonably good shape weren’t necessarily the ones with the fanciest strategies.

They were the ones who didn’t panic.

Looking Beyond the Worst 6 Months

Bouncebacks Happen More Often Than You Think

Historically, severe drawdowns have often been followed by above-average returns in subsequent years.

That’s not a guaranteemarkets don’t owe anyone a recovery on a set schedulebut it is a recurring pattern.

After 2022’s painful start and full-year losses, lower valuations and higher bond yields set the stage for better forward-looking returns.

In the years that followed, as inflation cooled and policy stabilized, many diversified portfolios saw significant improvement.

This is one of the hardest investing truths to internalize:

the times that feel the most hopeless often plant the seeds of the next upturn.

“Common Sense” Lessons to Take With You

If we boil down the “worst six months ever” into a few enduring lessons, they look something like this:

- Bad periods are inevitable; what matters is how you behave during them.

- Stocks can fall a lot. Bonds can fall too. That doesn’t mean capitalism is broken.

- Simple, diversified portfolios can still workeven if they occasionally have a truly awful year.

- Short-term performance rarely justifies blowing up a long-term plan.

- Having a frameworkyour own “wealth of common sense”beats reacting to every scary headline.

You can’t avoid every storm. But you can decide whether you’ll still be standing when the skies clear.

Real-World Experiences From the “Worst Six Months Ever”

Statistics are helpful, but they don’t capture what it actually feels like to live through a stretch like this.

To really understand the impact, imagine a few different investors trying to navigate those months.

The Young Investor Who Almost Gave Up

Emma is 29, finally making good money in her career, and had just gotten serious about investing.

She opened a retirement account in late 2021, dutifully picked a low-cost index fund, and felt very grown-up about the whole thing.

Six months later, she logged in and saw her account down over 20%. She hadn’t done anything “wrong,”

but it felt like the market was punishing her for trying. Friends were joking about “just staying in cash”

and her social media feed was full of doom.

The turning point? A conversation with a more experienced colleague who’d lived through the 2008 crisis.

He pulled up a long-term chart of the market, showed her all the scary dips, and then pointed out that the general direction was still up and to the right.

Emma stuck with her monthly contributions. A few years later, she would look back and realize those “awful” months had actually let her buy shares at a discount.

The Near-Retiree Who Needed a Real Plan

David was in a very different position. At 62, he was hoping to retire within three years.

His portfolio had done well in the long bull market, and he’d grown more aggressive over timealmost without noticing.

When the “worst six months ever” hit, his account dropped more than he thought possible.

Suddenly, a chunk of his retirement felt like it had vanished. He started wondering if he should delay retirement,

cancel travel plans, or move everything to cash “until things feel safer.”

Working with a planner, he realized his allocation was out of sync with his true risk tolerance and time horizon.

They rebuilt his portfolio with:

- Enough cash and short-term bonds to cover several years of planned withdrawals.

- A diversified mix of equities for long-term growth.

- A simple, rules-based rebalancing plan.

The market pain didn’t disappear, but his anxiety dropped sharply once his investments matched his actual life plan.

The lesson: sometimes a bad six-month stretch doesn’t ruin your retirementit just exposes that your portfolio and your goals weren’t fully aligned.

The Advisor Watching Everyone’s Emotions Spike

For financial advisors, those six months were a masterclass in behavior coaching.

Phone lines and inboxes lit up with predictable questions:

- “Should we sell everything and wait this out?”

- “Is this worse than 2008?”

- “Is 60/40 over? Should we switch strategies completely?”

The best advisors didn’t pretend to know the exact bottom or the precise timing of a recovery.

Instead, they went back to basics: reminding clients why they owned what they owned, revisiting goals and time horizons,

and calmly explaining what history says about drawdowns and recoveries.

Many also quietly helped clients take advantage of the chaos:

- Tax-loss harvesting in taxable accounts.

- Rebalancing portfolios by buying beaten-down asset classes.

- Encouraging clients still in the accumulation phase to keep adding to their accounts.

Years later, many of those same clients will barely remember the specific headlines.

What they will remember is whether they panickedor whether they had a framework and someone in their corner to help them stay the course.

Your Story Isn’t Written by Six Months

Whether you were Emma, David, or someone in between, one truth stands out:

your financial life is not defined by a single half-year, no matter how awful it feels in the moment.

Markets will have other terrible six-month stretches in the future.

That’s the price of admission for long-term growth. The real “wealth of common sense” lies in accepting that volatility,

preparing for it, and choosing not to let a brutal short-term chapter rewrite your long-term story.