Table of Contents >> Show >> Hide

- The 2023 “Split-Screen” SaaS Economy: Pain and Gains at the Same Time

- A Quick Reality Check: Big Gains Don’t Mean Easy Times

- The 25+ SaaS and Cloud Leaders That Were Up Big (Snapshot as of 11/27/2023)

- So… Why Were These SaaS and Cloud Stocks Up So Much?

- What the Winners Still Had to Prove (and Still Do)

- What Founders and Operators Can Learn from the 69% Average Rally

- What Buyers Can Do When SaaS Leaders Are Up and Budgets Are Tight

- Risks and Watch-Outs (Because Markets Love Humbling People)

- of Experiences: What 2023 Felt Like Inside SaaS and Cloud

- Conclusion: Tough Times, Clear Winners, and a Useful Signal

If you’ve been anywhere near SaaS lately, you’ve probably felt it: deals taking longer, CFOs asking “do we really need this tool,” and

pipelines moving at the speed of a politely confused sloth. Meanwhile, headlines keep reminding us that budgets are tight, hiring got weird,

and “efficiency” became the hottest product feature of 2023.

And yet… the public markets served a plot twist.

A basket of leading SaaS and cloud companies rallied hard in 2023. In fact, a snapshot of 25+ leaders (as of late November 2023) showed an

average stock gain of roughly ~69% year-to-date. That’s not a typo. That’s a “maybe the market is caffeinated” kind of number.

This article breaks down what happened, why the winners won, what patterns show up across the leaderboard, and what founders, operators,

and buyers can learnwithout pretending every company is living on a beach made of ARR.

(Also: this is market commentary, not investment advice. Please don’t mortgage your snack budget because a blog made a good point.)

The 2023 “Split-Screen” SaaS Economy: Pain and Gains at the Same Time

2023 was a year where two things were true at once:

(1) plenty of SaaS teams struggled with slower growth and tougher sales cycles, and

(2) a meaningful set of SaaS and cloud leaders saw their stock prices surge.

That’s not contradictoryit’s segmentation.

The “tough” side of the split-screen was fueled by familiar villains: higher interest rates (which punish long-duration growth stocks),

tighter procurement, vendor consolidation, and the hangover from the 2021 everything-bagel of valuations.

The “up” side? Investors started rewarding companies that proved they could grow and behave like responsible adults:

durable demand, real margins, real cash flow, and a believable AI story.

In other words: the market wasn’t saying “SaaS is back, baby!” so much as “SaaS is back… for the companies that look like they’ll still be

here when the next CFO asks for a haircut.”

A Quick Reality Check: Big Gains Don’t Mean Easy Times

A stock rally can happen even while growth slows. Many companies spent 2023 improving margins via hiring slowdowns, tighter spend,

and a renewed love affair with the phrase “operational rigor.”

Several leaders were also still below their 2021 peaksso part of 2023’s gain is “recovery” rather than “brand new euphoria.”

Still, a 60–200% year-to-date move is a loud signal: investors were willing to pay up again for certain cloud and SaaS narratives.

The interesting question is which narratives.

The 25+ SaaS and Cloud Leaders That Were Up Big (Snapshot as of 11/27/2023)

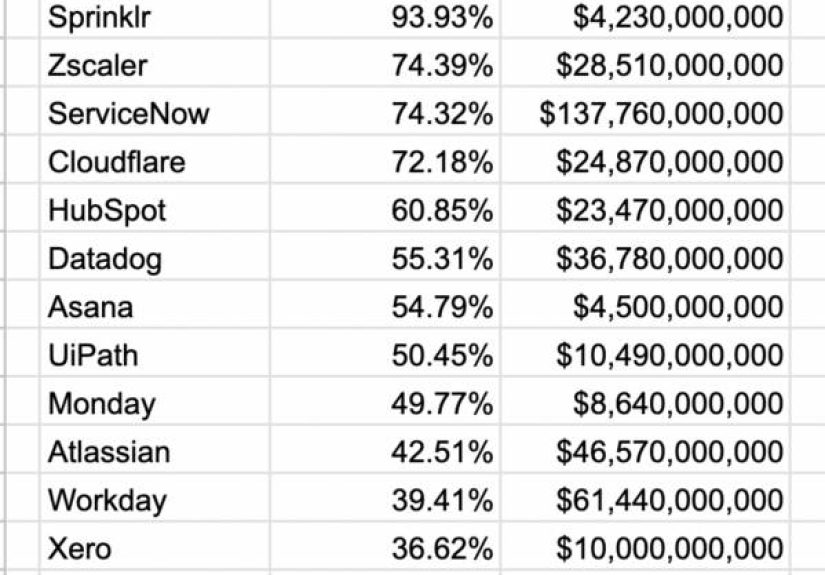

Below is a late-November 2023 snapshot of public SaaS and cloud leaders and their year-to-date stock gains (with approximate market caps at the time).

Consider it a “what the market rewarded” scoreboardnot a list of who had the nicest company swag.

| Company | YTD Stock Gain (as of 11/27/2023) | Approx. Market Cap (snapshot) |

|---|---|---|

| Palantir | 198.83% | $41.54B |

| Samsara | 124.75% | $14.33B |

| Fastly | 122.15% | $2.35B |

| MongoDB | 111.47% | $28.78B |

| Shopify | 106.73% | $94.74B |

| Braze | 106.06% | $5.25B |

| CrowdStrike | 104.06% | $50.32B |

| Sprinklr | 93.93% | $4.23B |

| AppFolio | 81.75% | $6.97B |

| Zscaler | 74.39% | $28.51B |

| ServiceNow | 74.32% | $137.76B |

| Cloudflare | 72.18% | $24.87B |

| HubSpot | 60.85% | $23.47B |

| Datadog | 55.31% | $36.78B |

| Asana | 54.79% | $4.50B |

| UiPath | 50.45% | $10.49B |

| monday.com | 49.77% | $8.64B |

| Atlassian | 42.51% | $46.57B |

| Workday | 39.41% | $61.44B |

| Xero | 36.62% | $10.00B |

| Wix | 29.79% | $5.60B |

| Freshworks | 27.82% | $5.60B |

| Snowflake | 26.28% | $56.40B |

| JFrog | 23.13% | $2.84B |

| Squarespace | 22.43% | $3.79B |

| SentinelOne | 21.96% | $5.30B |

Average gain: ~69.68% | Average market cap: ~$26.7B (snapshot).

Again: that’s a late-November 2023 snapshot, but it captures the core phenomenoncertain cloud and SaaS leaders were having a very different year

than the folks living inside “budget freeze” Slack channels.

So… Why Were These SaaS and Cloud Stocks Up So Much?

The winners aren’t random. When you zoom out, the list clusters into a few “market-loved” themes.

Think of it like a buffet: security, data/AI, mission-critical workflows, and platforms that become painful to rip out.

1) Security: The Budget Category That Refuses to Die

If revenue is a company’s heartbeat, security is the immune system. Most leaders don’t “pause” immune systems because the economy looks moody.

Names like CrowdStrike, Zscaler, and SentinelOne benefit from a simple truth:

risk doesn’t politely wait for better macro conditions.

Security platforms also benefit from consolidation. If a CISO can reduce tool sprawl while improving outcomes, that’s the kind of ROI story

procurement teams can put in a PowerPoint without sweating through their shirt.

2) Data Platforms + AI Gravity

AI didn’t just show up in 2023; it kicked down the door, moved in, and started charging rent. Companies tied to data infrastructure and analytics

caught a tailwindespecially those with clear “we help you build/operate AI” narratives.

MongoDB (developer adoption and modern data workloads), Snowflake (data cloud ecosystem),

Palantir (analytics plus an enterprise AI platform storyline), and Cloudflare (internet infrastructure)

rode that wave. The market was effectively betting that cloud demand would grow as AI workloads expandand that the “picks and shovels” players

would keep getting paid.

3) Mission-Critical Workflows Win in Slowdowns

In a slowdown, “nice-to-have” gets cut, but “if this breaks, payroll stops” survives.

ServiceNow (workflow automation), Workday (finance and HR),

and Atlassian (software team collaboration) sit close to the operational spine of large organizations.

These systems tend to have high switching costs, deeply embedded processes, and large installed bases.

When times get tough, that stickiness becomes a feature, not a bug.

4) Developer Love and Usage-Based Pull

Several names on the list have strong bottoms-up adoption dynamics: developers or operators start small, prove value, and expand.

That motion can be more resilient than relying exclusively on top-down, committee-driven enterprise selling.

Tools like Datadog (observability), Cloudflare (performance/security/network services),

and JFrog (software supply chain tooling) are often used by the people doing the worknot just the people approving budgets.

When value is obvious, expansion can happen even when budgets are “tight-ish.”

5) The Great Efficiency Reset (a.k.a. “We Found the Margin Button”)

A major reason SaaS recovered in 2023: many companies proved they could pull back on spending without completely face-planting growth.

Investors love that combo. It’s like watching someone run a mile fast while also carrying groceries without dropping the eggs.

The market’s message was blunt: show improving operating leverage, better free cash flow profiles, and a believable path to durable profitability

and you’ll get a warmer reception than the 2021 “growth at any cost” era.

What the Winners Still Had to Prove (and Still Do)

Even in a strong year, leaders still faced hard questions:

- Can growth re-accelerate? Cost cuts can only do so much; durable demand matters.

- Is the AI story real or marketing glitter? Customers can smell “AI washing.”

- Are net retention and expansion holding up? A churn problem doesn’t disappear because your stock chart looks cute.

- Is pricing power sustainable? Consolidation pressure can turn “premium” into “negotiated.”

In other words, a 2023 rally was not a lifetime achievement award. It was a renewed vote of confidencewith a very strict progress report due.

What Founders and Operators Can Learn from the 69% Average Rally

Stop selling “features.” Sell survival, savings, or speed.

The biggest commonality across the list is not a specific tech stack. It’s value clarity.

Security reduces existential risk. Workflow tools reduce friction. Data platforms help monetize information.

Observability reduces downtime. When customers can tie your product to dollars or risk reduction, you don’t have to beg for budget.

Make efficiency a product feature, not just a finance goal.

“We’re more efficient internally” is nice. “Our product makes you more efficient” is a purchase order.

The best SaaS leaders in 2023 didn’t just cut coststhey packaged efficiency into the narrative customers could justify.

AI is not a strategy; it’s an ingredient.

The market rewarded companies that positioned AI as a force multiplier:

better automation, better insights, better security, faster workflows.

If your AI story requires a 12-slide explanation, it’s probably not ready.

If a customer can feel it in week one, you’re onto something.

What Buyers Can Do When SaaS Leaders Are Up and Budgets Are Tight

If you’re on the buying side, 2023’s lesson isn’t “pay anything.”

It’s “buy the tools that cut other costs.”

Some practical moves:

- Consolidate vendors where platforms can replace point tools without losing capability.

- Negotiate on ramp schedules (start smaller, expand with proven ROI).

- Prioritize security and operational backbone tools before “nice dashboards.”

- Audit shelfwareyou probably have subscriptions that are basically donation programs.

Risks and Watch-Outs (Because Markets Love Humbling People)

A rally year doesn’t remove risk; it changes the shape of it. Key risks for SaaS and cloud companies include:

- Multiple compression if interest rates rise or growth disappoints.

- Competitive pressure from hyperscalers and bundled suites.

- AI cost structures (compute isn’t free; margins can get weird fast).

- Customer scrutiny around renewals, seat counts, and utilization.

Translation: the companies that win long-term will likely be the ones that can balance innovation with unit economicswithout turning every

roadmap into “Step 1: Add AI. Step 2: ??? Step 3: Profit.”

of Experiences: What 2023 Felt Like Inside SaaS and Cloud

Let’s get out of the stock charts for a second and talk about the human experience of this erabecause “up 69% on average” is not what it felt like

on a random Tuesday when your pipeline review started with the phrase, “So… about Q3.”

First, the vibe shift was real. In 2021, a lot of SaaS companies sold “future value.” In 2023, customers wanted “present value.”

It wasn’t enough to promise transformation; you had to show measurable outcomes fast. Demos turned into mini consulting sessions:

“Here’s how you cut onboarding time by 30%,” or “Here’s how you reduce breach risk,” or “Here’s what you can decommission if you buy us.”

If you couldn’t connect the dots to ROI, you got the classic corporate fade-out: “This is greatlet’s revisit next quarter.”

(Reader, next quarter never came.)

Second, procurement got bolder. Security reviews intensified, legal cycles stretched, and finance teams started asking for usage data

like they were detectives in a crime drama. The question wasn’t “Is this cool?” It was “Are people actually using it?”

That’s why products with built-in stickinessworkflows, data platforms, operational toolsfelt more resilient.

They weren’t just software; they were habits.

Third, “efficiency” became a competitive weapon. Teams bragged less about headcount and more about revenue per employee,

implementation speed, and how quickly a customer could see value. Companies that tightened executionfewer distractions,

clearer ICP, better onboardingoften looked stronger even if growth rates cooled.

You could feel it in how people talked: fewer moonshots, more “ship the thing that moves retention.”

Fourth, AI showed up as both opportunity and chaos. Some teams used AI to improve support, generate insights, automate workflows,

and make products meaningfully better. Others slapped “AI-powered” on a feature that was basically autocomplete with a fancy hat.

Customers learned to tell the difference quickly. The best conversations weren’t about AI as magic;

they were about AI as leverage: reducing manual work, finding anomalies, accelerating decisions, and improving outcomes.

Finally, the emotional whiplash was intense. In private markets, many founders felt pressure: slower funding, tougher terms, less hype.

In public markets, investors were quietly rewarding leaders that proved durability. Both realities can coexist.

The clearest takeaway from living through it: the “best” SaaS companies didn’t win because times were easy.

They won because they built products customers couldn’t ignoreand ran businesses investors couldn’t dismiss.

Conclusion: Tough Times, Clear Winners, and a Useful Signal

2023 didn’t deliver a universal SaaS comeback. It delivered a selective comeback.

A meaningful set of SaaS and cloud leaders rallied hardroughly 69% on average in a late-November snapshotwhile other segments battled

slow cycles and budget scrutiny.

If you’re building or buying in SaaS, the message is practical:

build for measurable value, bake in efficiency, align with durable budget categories, and treat AI as a tool that earns its keep.

The market may be moody, but it’s not random.