Table of Contents >> Show >> Hide

If you’re looking to delve into the world of investing, you’ve probably come across the term “margin trading.” It’s one of those concepts that can sound complicated at first, but with the right explanation, it’s easy to grasp. Margin trading is essentially borrowing money from a broker to trade financial assets, such as stocks, commodities, or cryptocurrencies. This type of trading can amplify your profits, but it also increases the risks. So, let’s break it down and explore the ins and outs of margin trading, including its potential benefits and drawbacks.

What is Margin Trading?

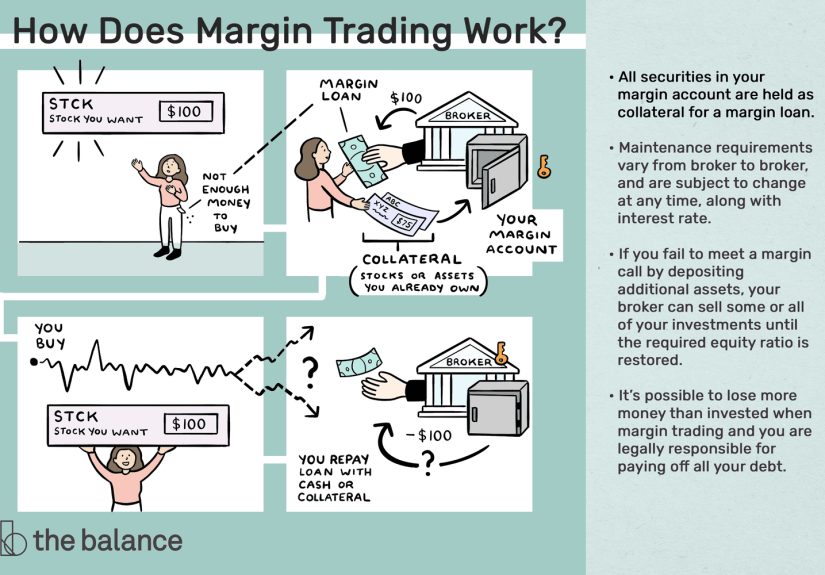

Margin trading refers to the practice of borrowing funds from a broker to trade a financial asset. In simple terms, you are using leverage to increase the size of your trade. When you buy on margin, you’re not just using your own capital to make an investment – you’re borrowing additional funds from a broker, which allows you to control a larger position than if you were using your own money alone. This can lead to higher returns if the market moves in your favor, but it can also result in significant losses if the market goes against you.

How Margin Trading Works

To understand how margin trading works, let’s consider an example. Let’s say you want to buy 100 shares of a company at $100 each, but you only have $5,000. With margin trading, you could borrow the remaining $5,000 from your broker to make the trade. This allows you to control a $10,000 position in the market with just $5,000 of your own capital. The amount you borrow is referred to as “the margin loan,” and the $5,000 you initially invested is your “margin requirement.” The key here is that you are using leverage, which means that your potential profits or losses are magnified.

Key Terms in Margin Trading

Here are some essential terms you should know when it comes to margin trading:

- Initial Margin: The minimum amount of capital you need to deposit with your broker in order to open a margin position.

- Maintenance Margin: The minimum equity you must maintain in your margin account to keep your position open. If your account falls below this threshold, you may receive a margin call.

- Margin Call: A request from your broker for you to deposit additional funds into your account if your equity falls below the maintenance margin level.

- Leverage: The ratio of borrowed funds to your own capital. A higher leverage means that your gains and losses will be more significant.

The Pros and Cons of Margin Trading

Like any trading strategy, margin trading comes with both its advantages and disadvantages. Let’s take a look at the pros and cons:

Pros of Margin Trading

- Increased Buying Power: The most obvious advantage of margin trading is that it allows you to control more significant positions than you could with just your own capital. This means you can potentially earn more profits in a shorter period.

- Leverage Your Profits: If the market moves in your favor, margin trading allows you to make substantial returns on your initial investment. For example, with 2:1 leverage, you could double your profit on a successful trade.

- Flexibility: Margin trading provides flexibility in your trading strategy, allowing you to take on larger positions without needing to commit more capital upfront.

Cons of Margin Trading

- Increased Risk: While margin trading can amplify your profits, it also magnifies your losses. If the market moves against you, you could lose more money than you initially invested, and you might even owe your broker more than your initial deposit.

- Margin Calls: If the value of your position falls below a certain level, your broker may issue a margin call, requiring you to deposit additional funds into your account to maintain your position. If you fail to do so, your position may be liquidated, leading to significant losses.

- Interest Costs: When you borrow funds on margin, you are typically required to pay interest on the loan. These interest costs can add up over time and eat into your profits.

Examples of Margin Trading

Let’s look at a couple of examples of how margin trading works in practice.

Example 1: Stock Trading

Imagine you want to buy 500 shares of a company, and each share costs $50. If you have $10,000 in your margin account, you can borrow an additional $10,000 from your broker, allowing you to control $20,000 worth of shares. If the stock price rises to $60, you can sell your shares for $30,000, making a $10,000 profit. After paying back the $10,000 loan, you’re left with $10,000 in profit.

Example 2: Cryptocurrency Margin Trading

Margin trading is also popular in the cryptocurrency market. For example, let’s say you want to buy Bitcoin at $40,000 per coin, but you only have $10,000. With margin trading, you can borrow an additional $10,000 from your broker. If the price of Bitcoin rises to $45,000, you can sell your position and make a profit. However, if the price drops to $35,000, you could lose your initial deposit or even owe more than you borrowed.

Is Margin Trading Right for You?

Margin trading can be an excellent way to amplify your returns, but it’s not without its risks. Before you engage in margin trading, it’s essential to consider your risk tolerance, financial goals, and experience level. If you’re new to trading, it’s advisable to start with smaller trades and gradually increase your position as you gain more experience. Always remember that margin trading is a high-risk strategy, and it’s crucial to fully understand how it works before diving in.

Conclusion

Margin trading allows investors to amplify their potential profits by borrowing money from a broker to trade assets. However, it also comes with substantial risks, as the potential for losses is magnified. It’s important to carefully weigh the pros and cons of margin trading and understand the risks before engaging in this type of trading. Whether margin trading is suitable for you depends on your investment strategy, risk tolerance, and experience level.

Additionally, many traders advise using margin trading cautiously, especially if you’re new to the market. Even seasoned professionals can struggle when the market moves against them. Some recommend always setting stop-loss orders when trading on margin, as these can automatically sell your position if it loses a certain amount, helping to prevent a margin call. Others suggest keeping your margin level low, ensuring that your exposure to risk is manageable.

In the end, margin trading can be an exciting but risky endeavor. It’s essential to use this strategy with caution and to fully understand the risks involved. By educating yourself, practicing with smaller trades, and staying disciplined in your approach, you can potentially capitalize on the benefits that margin trading offers. However, always remember that the risks are substantial, and margin trading is not suitable for everyone.